Authors

Summary

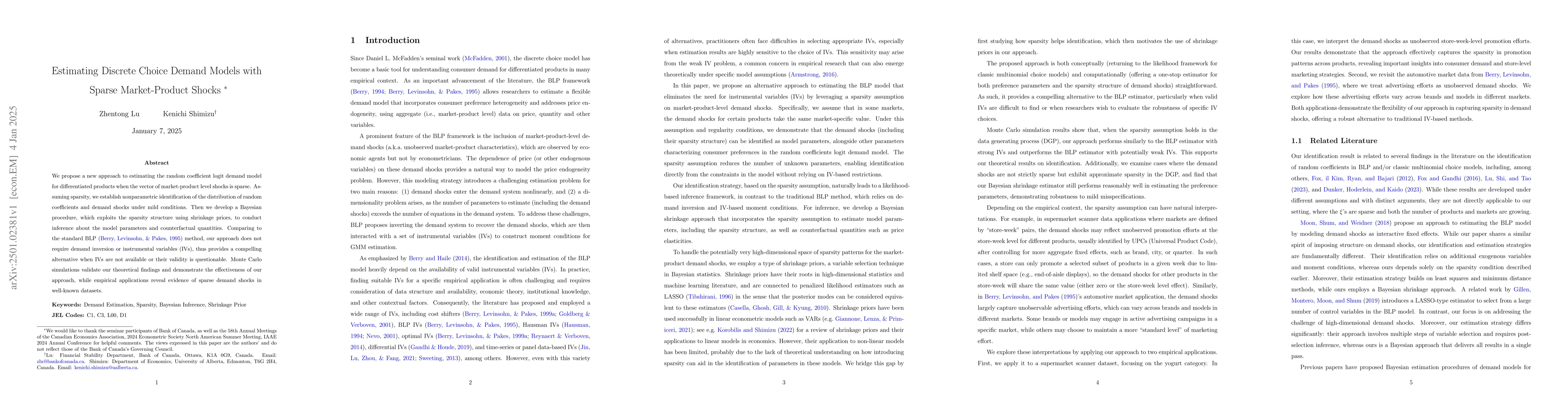

We propose a new approach to estimating the random coefficient logit demand model for differentiated products when the vector of market-product level shocks is sparse. Assuming sparsity, we establish nonparametric identification of the distribution of random coefficients and demand shocks under mild conditions. Then we develop a Bayesian procedure, which exploits the sparsity structure using shrinkage priors, to conduct inference about the model parameters and counterfactual quantities. Comparing to the standard BLP (Berry, Levinsohn, & Pakes, 1995) method, our approach does not require demand inversion or instrumental variables (IVs), thus provides a compelling alternative when IVs are not available or their validity is questionable. Monte Carlo simulations validate our theoretical findings and demonstrate the effectiveness of our approach, while empirical applications reveal evidence of sparse demand shocks in well-known datasets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEstimating Demand with Recentered Instruments

Peter Hull, Kirill Borusyak, Mauricio Caceres Bravo

Demand and Welfare Analysis in Discrete Choice Models with Social Interactions

Debopam Bhattacharya, Pascaline Dupas, Shin Kanaya

| Title | Authors | Year | Actions |

|---|

Comments (0)