Summary

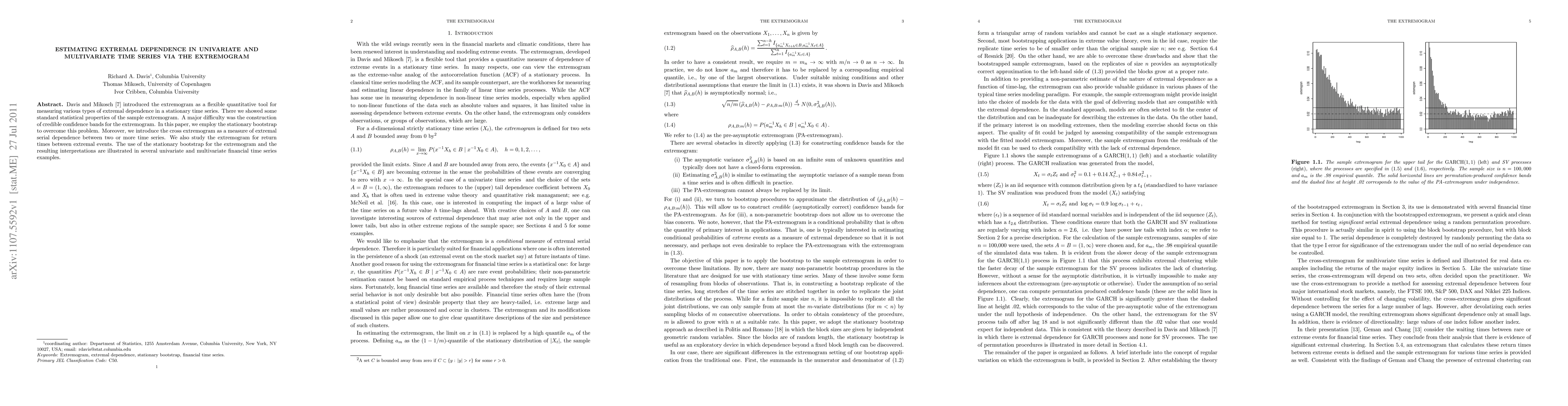

Davis and Mikosch [7] introduced the extremogram as a flexible quantitative tool for measuring various types of extremal dependence in a stationary time series. There we showed some standard statistical properties of the sample extremogram. A major difficulty was the construction of credible confidence bands for the extremogram. In this paper, we employ the stationary bootstrap to overcome this problem. Moreover, we introduce the cross extremogram as a measure of extremal serial dependence between two or more time series. We also study the extremogram for return times between extremal events. The use of the stationary bootstrap for the extremogram and the resulting interpretations are illustrated in several univariate and multivariate financial time series examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralized Prompt Tuning: Adapting Frozen Univariate Time Series Foundation Models for Multivariate Healthcare Time Series

George H. Chen, Mingzhu Liu, Angela H. Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)