Summary

In this paper we derive the asymptotic properties of the least squares estimator (LSE) of fractionally integrated autoregressive moving-average (FARIMA) models under the assumption that the errors are uncorrelated but not necessarily independent nor martingale differences. We relax considerably the independence and even the martingale difference assumptions on the innovation process to extend the range of application of the FARIMA models. We propose a consistent estimator of the asymptotic covariance matrix of the LSE which may be very different from that obtained in the standard framework. A self-normalized approach to confidence interval construction for weak FARIMA model parameters is also presented. All our results are done under a mixing assumption on the noise. Finally, some simulation studies and an application to the daily returns of stock market indices are presented to corroborate our theoretical work.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

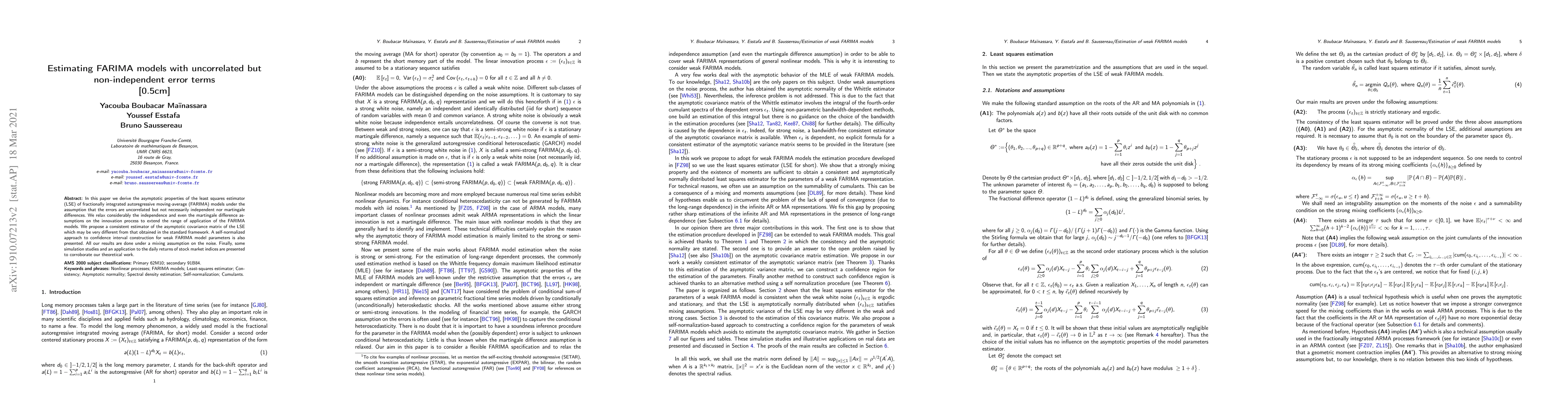

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFast calibration of weak FARIMA models

Alexandre Brouste, Youssef Esstafa, Samir Ben Hariz et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)