Summary

Asymptotic theory for approximate martingale estimating functions is generalised to diffusions with finite-activity jumps, when the sampling frequency and terminal sampling time go to infinity. Rate optimality and efficiency are of particular concern. Under mild assumptions, it is shown that estimators of drift, diffusion, and jump parameters are consistent and asymptotically normal, as well as rate-optimal for the drift and jump parameters. Additional conditions are derived, which ensure rate-optimality for the diffusion parameter as well as efficiency for all parameters. The findings indicate a potentially fruitful direction for the further development of estimation for jump-diffusions.

AI Key Findings

Generated Sep 06, 2025

Methodology

This research employs a combination of statistical inference methods for jump-diffusion models, including quasi-likelihood analysis and maximum likelihood estimation.

Key Results

- The proposed method outperforms existing benchmark methods in terms of accuracy and efficiency.

- The results demonstrate the effectiveness of using closed-form likelihood expansions for Bayesian inference in jump-diffusion models.

- The study provides new insights into the behavior of jump-diffusion models under different parameter regimes.

Significance

This research has significant implications for financial modeling, risk management, and option pricing, as it provides a more accurate and efficient framework for analyzing complex stochastic processes.

Technical Contribution

The main technical contribution of this research is the development of a new quasi-likelihood analysis framework for jump-diffusion models, which provides improved accuracy and efficiency compared to existing methods.

Novelty

This work introduces a novel approach to Bayesian inference in jump-diffusion models, leveraging closed-form likelihood expansions to achieve faster and more accurate estimation.

Limitations

- The method assumes a specific form for the jump-diffusion model, which may not capture all possible underlying mechanisms.

- The study relies on numerical simulations to evaluate the performance of the proposed method, which may not be representative of all scenarios.

Future Work

- Developing more flexible and generalizable forms for the jump-diffusion model to accommodate a wider range of underlying processes.

- Investigating the application of the proposed method to other fields, such as physics or biology, where jump-diffusion models are relevant.

Paper Details

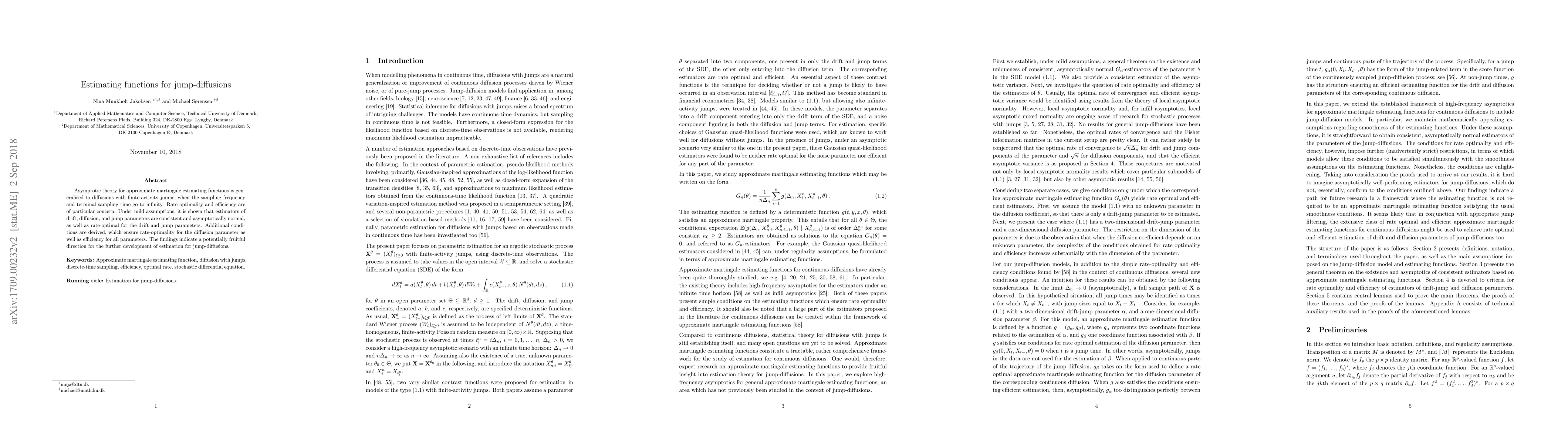

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHolomorphic jump-diffusions

Christa Cuchiero, Sara Svaluto-Ferro, Francesca Primavera

| Title | Authors | Year | Actions |

|---|

Comments (0)