Summary

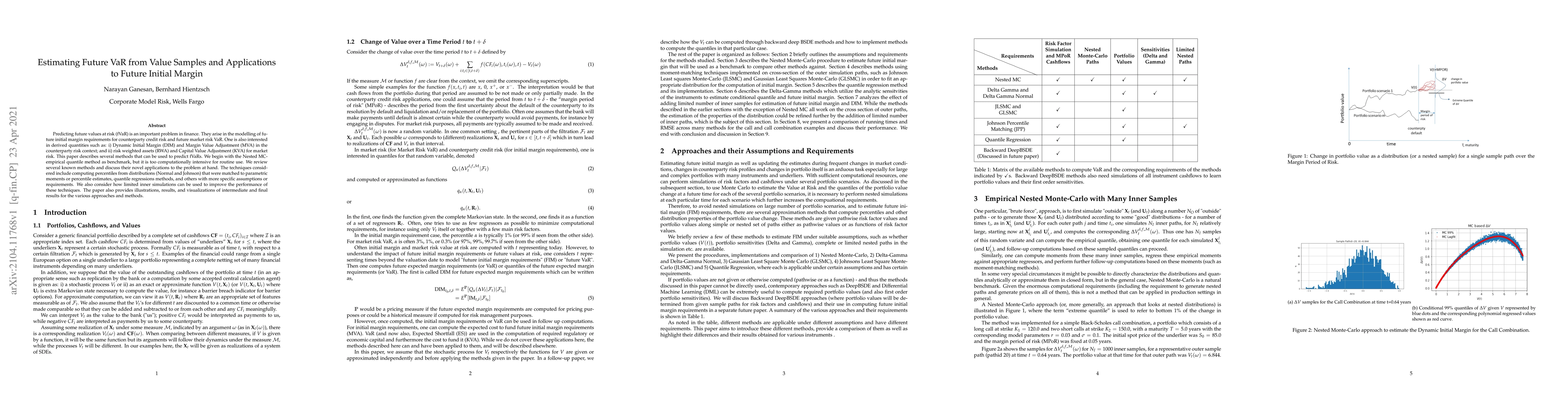

Predicting future values at risk (fVaR) is an important problem in finance. They arise in the modelling of future initial margin requirements for counterparty credit risk and future market risk VaR. One is also interested in derived quantities such as: i) Dynamic Initial Margin (DIM) and Margin Value Adjustment (MVA) in the counterparty risk context; and ii) risk weighted assets (RWA) and Capital Value Adjustment (KVA) for market risk. This paper describes several methods that can be used to predict fVaRs. We begin with the Nested MC-empirical quantile method as benchmark, but it is too computationally intensive for routine use. We review several known methods and discuss their novel applications to the problem at hand. The techniques considered include computing percentiles from distributions (Normal and Johnson) that were matched to parametric moments or percentile estimates, quantile regressions methods, and others with more specific assumptions or requirements. We also consider how limited inner simulations can be used to improve the performance of these techniques. The paper also provides illustrations, results, and visualizations of intermediate and final results for the various approaches and methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Deep Learning for computing the Dynamic Initial Margin and Margin Value Adjustment

Álvaro Leitao, Joel P. Villarino

No citations found for this paper.

Comments (0)