Summary

In this paper, we investigate risk measures such as value at risk (VaR) and the conditional tail expectation (CTE) of the extreme (maximum and minimum) and the aggregate (total) of two dependent risks. In finance, insurance and the other fields, when people invest their money in two or more dependent or independent markets, it is very important to know the extreme and total risk before the investment. To find these risk measures for dependent cases is quite challenging, which has not been reported in the literature to the best of our knowledge. We use the FGM copula for modelling the dependence as it is relatively simple for computational purposes and has empirical successes. The marginal of the risks are considered as exponential and pareto, separately, for the case of extreme risk and as exponential for the case of the total risk. The effect of the degree of dependency on the VaR and CTE of the extreme and total risks is analyzed. We also make comparisons for the dependent and independent risks. Moreover, we propose a new risk measure called median of tail (MoT) and investigate MoT for the extreme and aggregate dependent risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

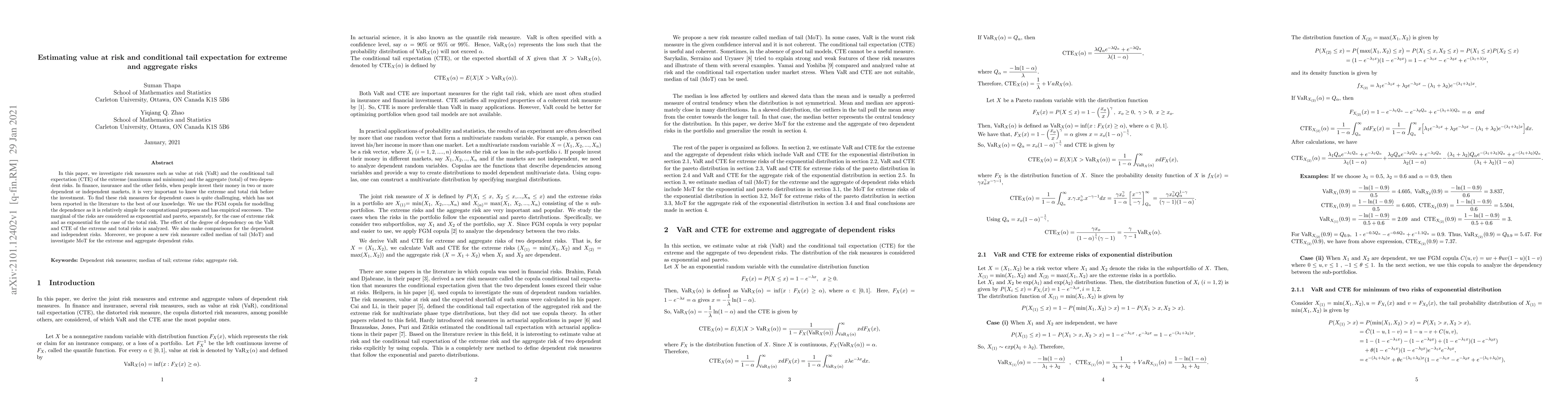

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNew Bayesian method for estimation of Value at Risk and Conditional Value at Risk

Jacinto Martín, M. Isabel Parra, Eva L. Sanjuán et al.

No citations found for this paper.

Comments (0)