Summary

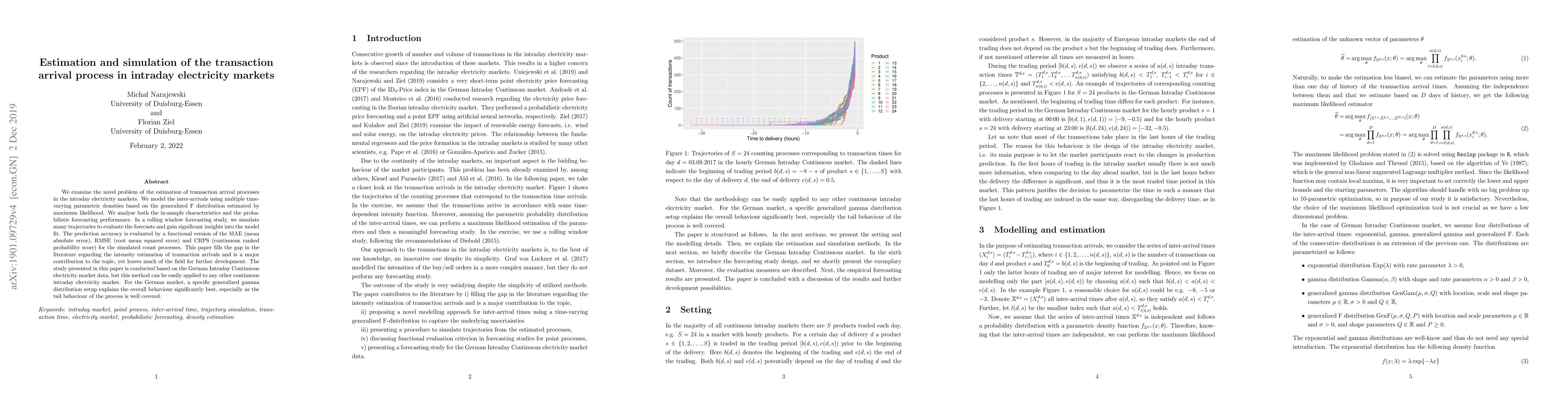

We examine the novel problem of the estimation of transaction arrival processes in the intraday electricity markets. We model the inter-arrivals using multiple time-varying parametric densities based on the generalized F distribution estimated by maximum likelihood. We analyse both the in-sample characteristics and the probabilistic forecasting performance. In a rolling window forecasting study, we simulate many trajectories to evaluate the forecasts and gain significant insights into the model fit. The prediction accuracy is evaluated by a functional version of the MAE (mean absolute error), RMSE (root mean squared error) and CRPS (continuous ranked probability score) for the simulated count processes. This paper fills the gap in the literature regarding the intensity estimation of transaction arrivals and is a major contribution to the topic, yet leaves much of the field for further development. The study presented in this paper is conducted based on the German Intraday Continuous electricity market data, but this method can be easily applied to any other continuous intraday electricity market. For the German market, a specific generalized gamma distribution setup explains the overall behaviour significantly best, especially as the tail behaviour of the process is well covered.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Machine Learning Approach for Prosumer Management in Intraday Electricity Markets

Mohammad Reza Hesamzadeh, Saeed Mohammadi

| Title | Authors | Year | Actions |

|---|

Comments (0)