Summary

We develop a general class of noise-robust estimators based on the existing estimators in the non-noisy high-frequency data literature. The microstructure noise is a parametric function of the limit order book. The noise-robust estimators are constructed as plug-in versions of their counterparts, where we replace the efficient price, which is non-observable, by an estimator based on the raw price and limit order book data. We show that the technology can be applied to five leading examples where, depending on the problem, price possibly includes infinite jump activity and sampling times encompass asynchronicity and endogeneity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

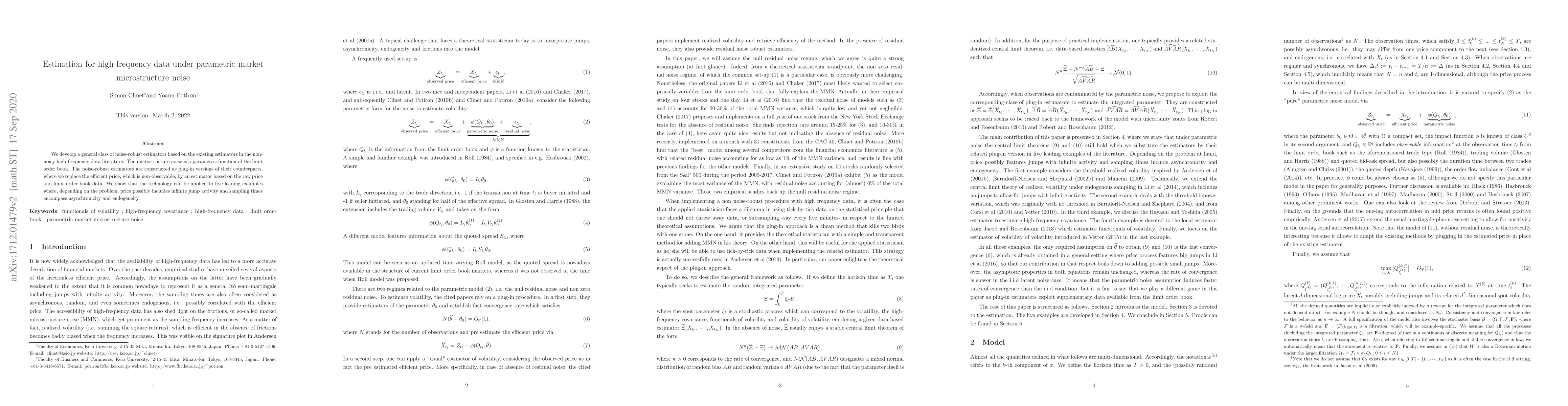

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)