Summary

We propose a Kronecker product model for correlation or covariance matrices in the large dimensional case. The number of parameters of the model increases logarithmically with the dimension of the matrix. We propose a minimum distance (MD) estimator based on a log-linear property of the model, as well as a one-step estimator, which is a one-step approximation to the quasi-maximum likelihood estimator (QMLE). We establish rates of convergence and central limit theorems (CLT) for our estimators in the large dimensional case. A specification test and tools for Kronecker product model selection and inference are provided. In a Monte Carlo study where a Kronecker product model is correctly specified, our estimators exhibit superior performance. In an empirical application to portfolio choice for SP500 daily returns, we demonstrate that certain Kronecker product models are good approximations to the general covariance matrix.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

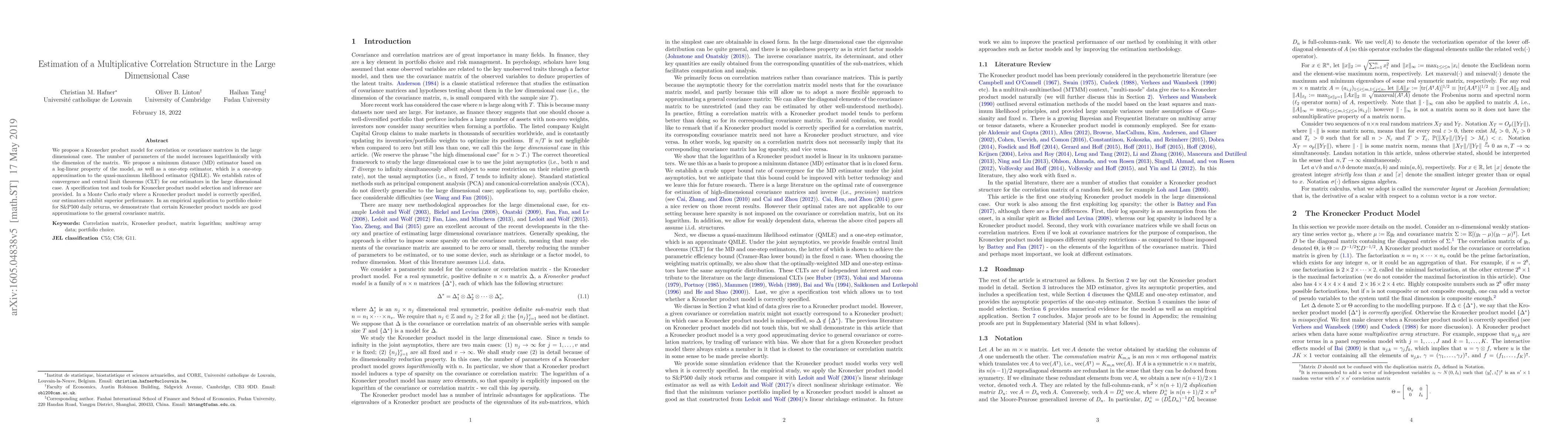

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe J-PLUS collaboration. Additive versus multiplicative systematics in surveys of the large scale structure of the Universe

A. Hernán-Caballero, E. Tempel, C. López-Sanjuan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)