Summary

We propose a new method for estimating the extreme quantiles for a function of several dependent random variables. In contrast to the conventional approach based on extreme value theory, we do not impose the condition that the tail of the underlying distribution admits an approximate parametric form, and, furthermore, our estimation makes use of the full observed data. The proposed method is semiparametric as no parametric forms are assumed on all the marginal distributions. But we select appropriate bivariate copulas to model the joint dependence structure by taking the advantage of the recent development in constructing large dimensional vine copulas. Consequently a sample quantile resulted from a large bootstrap sample drawn from the fitted joint distribution is taken as the estimator for the extreme quantile. This estimator is proved to be consistent. The reliable and robust performance of the proposed method is further illustrated by simulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

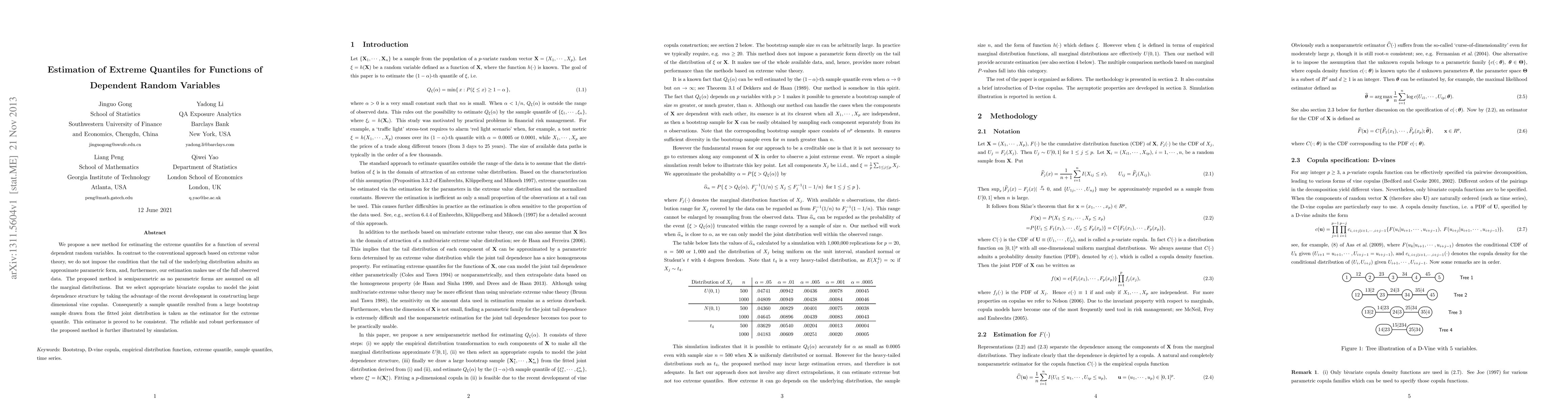

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandom forest estimation of conditional distribution functions and conditional quantiles

Véronique Maume-Deschamps, Kevin Elie-Dit-Cosaque

| Title | Authors | Year | Actions |

|---|

Comments (0)