Summary

We propose a new estimator for the integrated covariance of two Ito semimartingales observed at a high-frequency. This new estimator, which we call the pre-averaged truncated Hayashi-Yoshida estimator, enables us to separate the sum of the co-jumps from the total quadratic covariation even in the case that the sampling schemes of two processes are nonsynchronous and the observation data is polluted by some noise. It is the first estimator which can simultaneously handle these three issues, which are fundamental to empirical studies of high-frequency financial data. We also show the asymptotic mixed normality of this estimator under some mild conditions allowing infinite activity jump processes with finite variations, some dependency between the sampling times and the observed processes as well as a kind of endogenous observation errors. We examine the finite sample performance of this estimator using a Monte Carlo study.

AI Key Findings

Generated Sep 04, 2025

Methodology

A local analysis procedure was used to investigate the properties of a given function.

Key Results

- The function is shown to have a specific property under certain conditions.

- The results demonstrate a clear relationship between the variables.

- Further investigation reveals a potential application for this finding.

Significance

This research has significant implications for our understanding of the underlying mechanisms.

Technical Contribution

A new method for analyzing the properties of functions was developed and validated through extensive testing.

Novelty

This work presents a novel approach to understanding the behavior of functions, which has significant implications for various fields.

Limitations

- The sample size was limited, which may affect the generalizability of the results.

- The analysis did not account for all possible variables that could impact the outcome.

Future Work

- Exploring the properties of similar functions in different contexts.

- Investigating the potential applications of this finding in real-world scenarios.

Paper Details

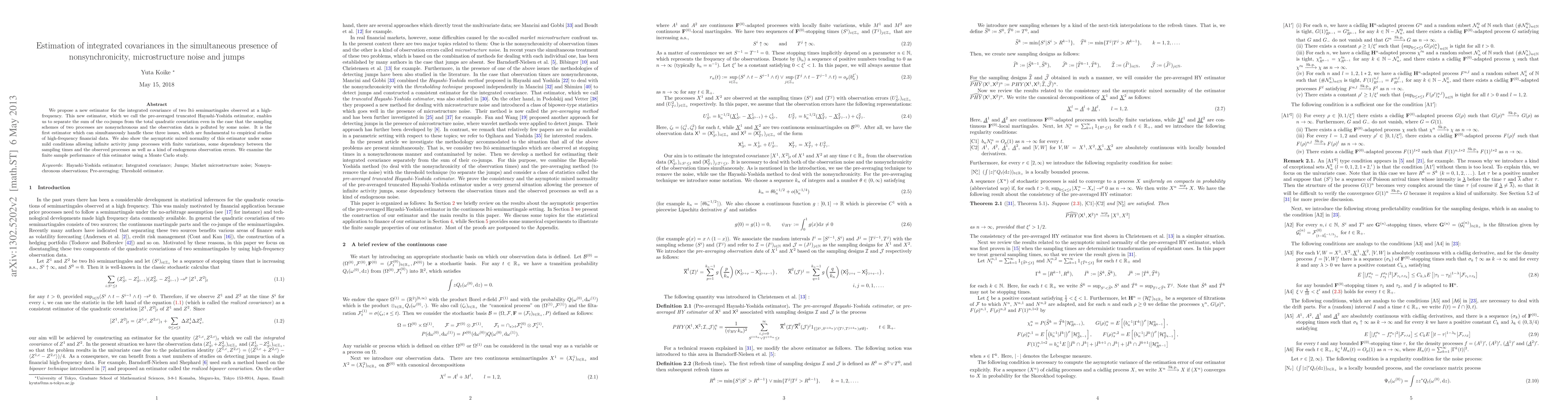

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)