Authors

Summary

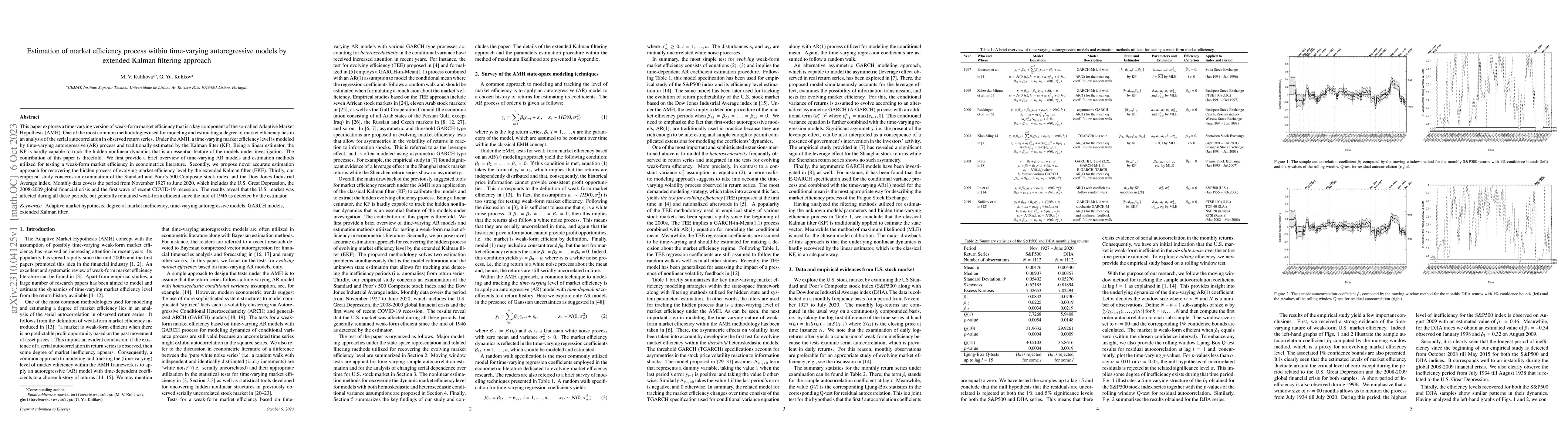

This paper explores a time-varying version of weak-form market efficiency that is a key component of the so-called Adaptive Market Hypothesis (AMH). One of the most common methodologies used for modeling and estimating a degree of market efficiency lies in an analysis of the serial autocorrelation in observed return series. Under the AMH, a time-varying market efficiency level is modeled by time-varying autoregressive (AR) process and traditionally estimated by the Kalman filter (KF). Being a linear estimator, the KF is hardly capable to track the hidden nonlinear dynamics that is an essential feature of the models under investigation. The contribution of this paper is threefold. We first provide a brief overview of time-varying AR models and estimation methods utilized for testing a weak-form market efficiency in econometrics literature. Secondly, we propose novel accurate estimation approach for recovering the hidden process of evolving market efficiency level by the extended Kalman filter (EKF). Thirdly, our empirical study concerns an examination of the Standard and Poor's 500 Composite stock index and the Dow Jones Industrial Average index. Monthly data covers the period from November 1927 to June 2020, which includes the U.S. Great Depression, the 2008-2009 global financial crisis and the first wave of recent COVID-19 recession. The results reveal that the U.S. market was affected during all these periods, but generally remained weak-form efficient since the mid of 1946 as detected by the estimator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistributed Time-Varying Gaussian Regression via Kalman Filtering

Giulia De Pasquale, Florian Dorfler, Jaap Eising et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)