Summary

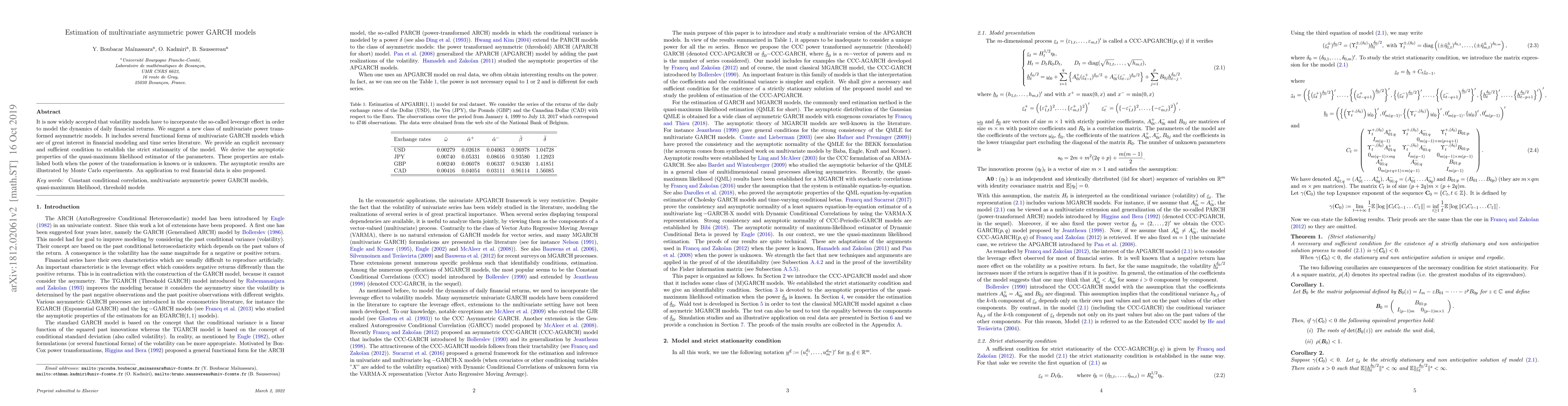

It is now widely accepted that volatility models have to incorporate the so-called leverage effect in order to to model the dynamics of daily financial returns.We suggest a new class of multivariate power transformed asymmetric models. It includes several functional forms of multivariate GARCH models which are of great interest in financial modeling and time series literature. We provide an explicit necessary and sufficient condition to establish the strict stationarity of the model. We derive the asymptotic properties of the quasi-maximum likelihood estimator of the parameters. These properties are established both when the power of the transformation is known or is unknown. The asymptotic results are illustrated by Monte Carlo experiments. An application to real financial data is also proposed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortmanteau test for a class of multivariate asymmetric power GARCH model

Yacouba Boubacar Maïnassara, Bruno Saussereau, Othman Kadmiri

Deep Learning Enhanced Multivariate GARCH

Chen Liu, Chao Wang, Minh-Ngoc Tran et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)