Summary

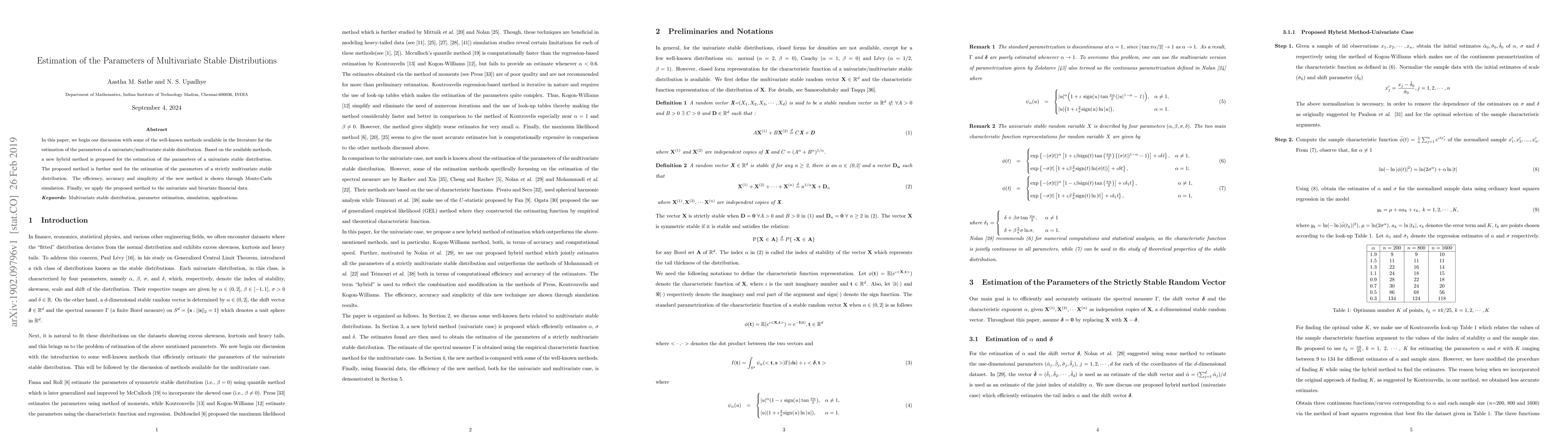

In this paper, we begin our discussion with some of the well-known methods available in the literature for the estimation of the parameters of a univariate/multivariate stable distribution. Based on the available methods, a new hybrid method is proposed for the estimation of the parameters of a univariate stable distribution. The proposed method is further used for the estimation of the parameters of a strictly multivariate stable distribution. The efficiency, accuracy, and simplicity of the new method is shown through Monte-Carlo simulation. Finally, we apply the proposed method to the univariate and bivariate financial data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)