Authors

Summary

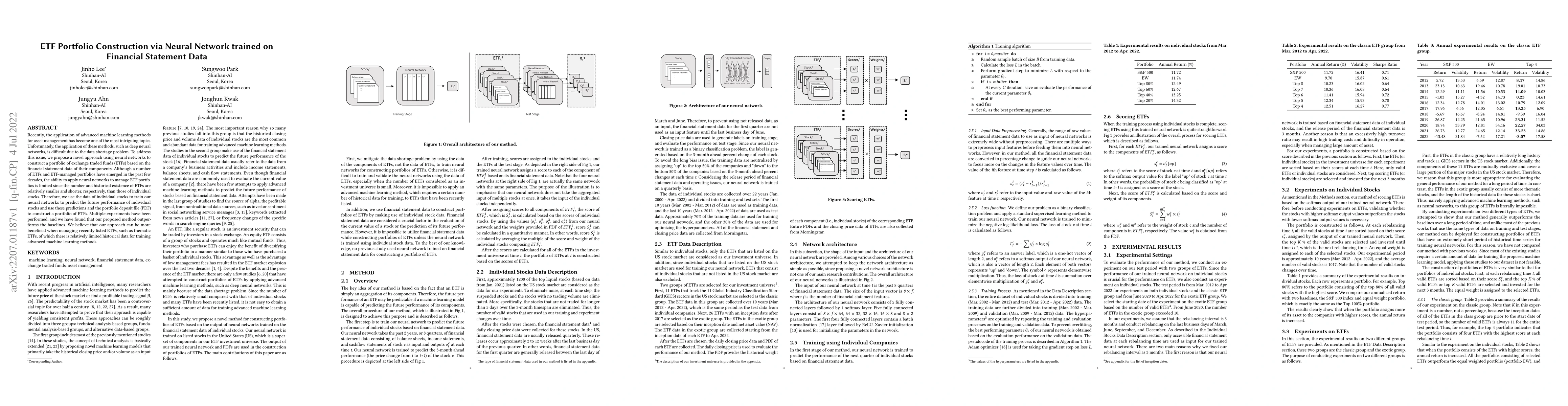

Recently, the application of advanced machine learning methods for asset management has become one of the most intriguing topics. Unfortunately, the application of these methods, such as deep neural networks, is difficult due to the data shortage problem. To address this issue, we propose a novel approach using neural networks to construct a portfolio of exchange traded funds (ETFs) based on the financial statement data of their components. Although a number of ETFs and ETF-managed portfolios have emerged in the past few decades, the ability to apply neural networks to manage ETF portfolios is limited since the number and historical existence of ETFs are relatively smaller and shorter, respectively, than those of individual stocks. Therefore, we use the data of individual stocks to train our neural networks to predict the future performance of individual stocks and use these predictions and the portfolio deposit file (PDF) to construct a portfolio of ETFs. Multiple experiments have been performed, and we have found that our proposed method outperforms the baselines. We believe that our approach can be more beneficial when managing recently listed ETFs, such as thematic ETFs, of which there is relatively limited historical data for training advanced machine learning methods.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research proposes a method for constructing ETF portfolios using neural networks trained on financial statement data of individual stocks. It addresses the data shortage problem by training on individual stock data and predicting their future performance, then using these predictions and ETF portfolio deposit files (PDF) to construct ETF portfolios.

Key Results

- The proposed method outperforms baseline approaches in portfolio construction.

- The method is particularly beneficial for managing recently listed ETFs with limited historical data.

Significance

This research is significant as it introduces a novel approach to ETF portfolio management using neural networks and financial statement data, which can be especially useful for thematic ETFs with limited historical data.

Technical Contribution

The paper presents an innovative approach to ETF portfolio construction by leveraging neural networks trained on individual stock financial statement data, addressing the data shortage problem inherent in ETF portfolio management.

Novelty

This work is novel as it is the first to use financial statement data to train neural networks for constructing ETF portfolios, offering a solution for managing ETFs with limited historical data.

Limitations

- The method relies on the availability of financial statement data for individual stocks.

- Performance is contingent on the accuracy of the neural network's predictions for individual stocks.

Future Work

- Explore the application of this method to other asset classes beyond ETFs.

- Investigate the use of alternative machine learning methods for predicting stock performance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSTRAPSim: A Portfolio Similarity Metric for ETF Alignment and Portfolio Trades

Mingshu Li, Dhruv Desai, Philip Sommer et al.

No citations found for this paper.

Comments (0)