Summary

We propose a new model for electricity pricing based on the price cap principle. The particularity of the model is that the asset price is an exponential functional of a jump L\'evy process. This model can capture both mean reversion and jumps which are observed in electricity market. It is shown that the value of an European option of this asset is the unique viscosity solution of a partial integro-differential equation (PIDE). A numerical approximation of this solution by the finite differences method is provided. The consistency, stability and convergence results of the scheme are given. Numerical simulations are performed under a smooth initial condition.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

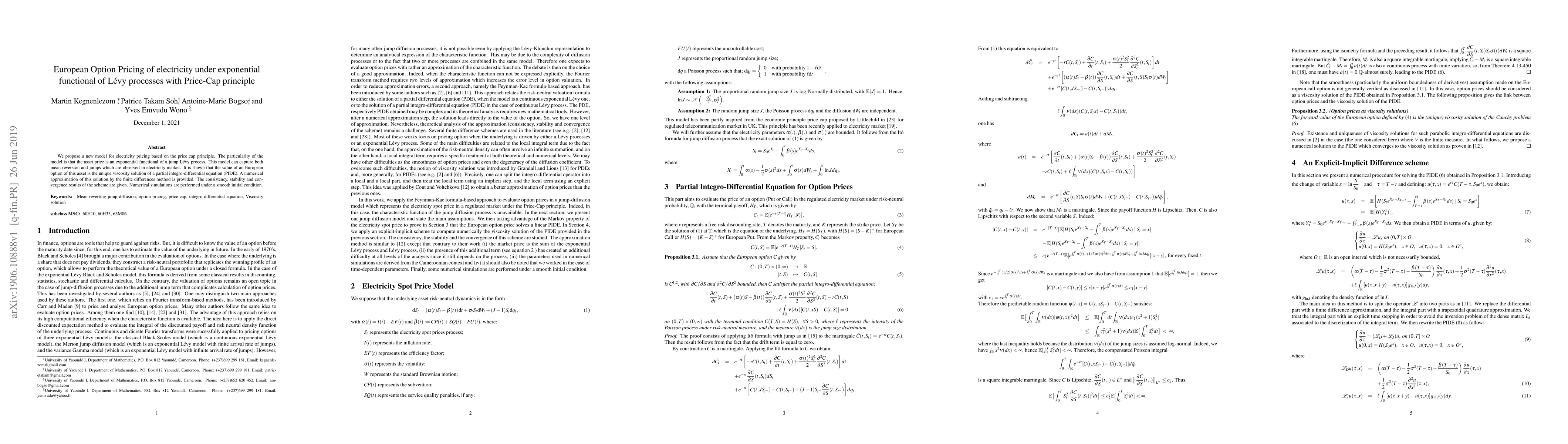

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)