Authors

Summary

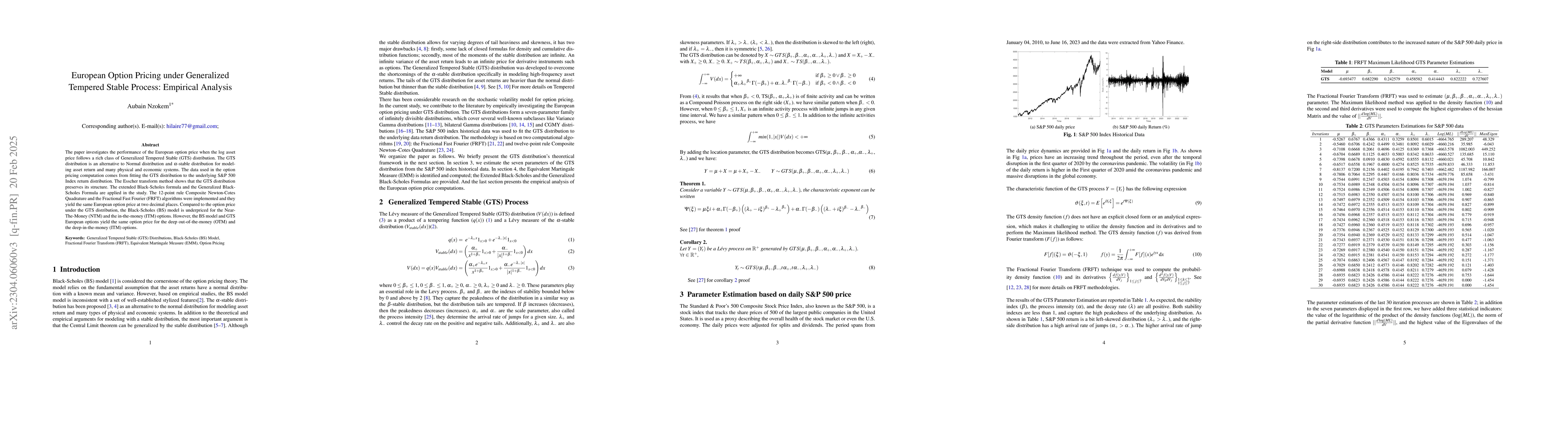

The paper investigates the performance of the European option price when the log asset price follows a rich class of Generalized Tempered Stable (GTS) distribution. The GTS distribution is an alternative to Normal distribution and $\alpha$-stable distribution for modeling asset return and many physical and economic systems. The data used in the option pricing computation comes from fitting the GTS distribution to the underlying S\&P 500 Index return distribution. The Esscher transform method shows that the GTS distribution preserves its structure. The extended Black-Scholes formula and the Generalized Black-Scholes Formula are applied in the study. The 12-point rule Composite Newton-Cotes Quadrature and the Fractional Fast Fourier (FRFT) algorithms were implemented and they yield the same European option price at two decimal places. Compared to the option price under the GTS distribution, the Black-Scholes (BS) model is underpriced for the near-the-Money (NTM) and the in-the-money (ITM) options. However, the BS model and GTS European options yield the same option price for the deep out-of-the-money (OTM) and the deep-in-the-money (ITM) options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)