Authors

Summary

We propose a general framework of European power option pricing under two different market assumptions about extended Vasic\v{e}k interest rate process and exponential Ornstein-Uhlenbeck asset process with continuous dividend as underlying, in which the Brownian motions involved in Vasic\v{e}k interest rate and exponential Ornstein-Uhlenbeck process are time-dependent correlated in equivalent martingale measure probability space or real-world probability space respectively. We first develop European power option pricing in two types of payoffs with martingale method under the market assumption that Vasic\v{e}k interest rate and exponential Ornstein-Uhlenbeck process are correlated in equivalent martingale measure probability space. Then, we solve the European power option pricing under the market assumption that Vasic\v{e}k interest rate and exponential Ornstein-Uhlenbeck process are correlated in real-world probability by constructing a Girsannov transform to map real-world probability to risk-neutral equivalent martingale measure. Finally, the European power option pricing formulae are derived with numeraire change and T-forward measure under the above two market assumptions in a uniform theoretical framework and close formulae expression.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

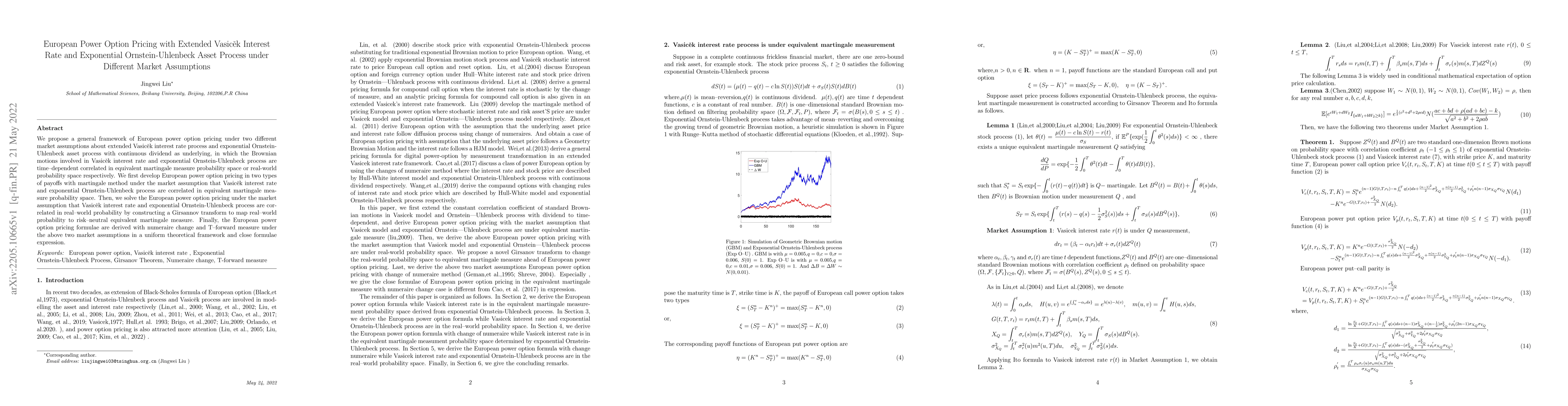

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)