Summary

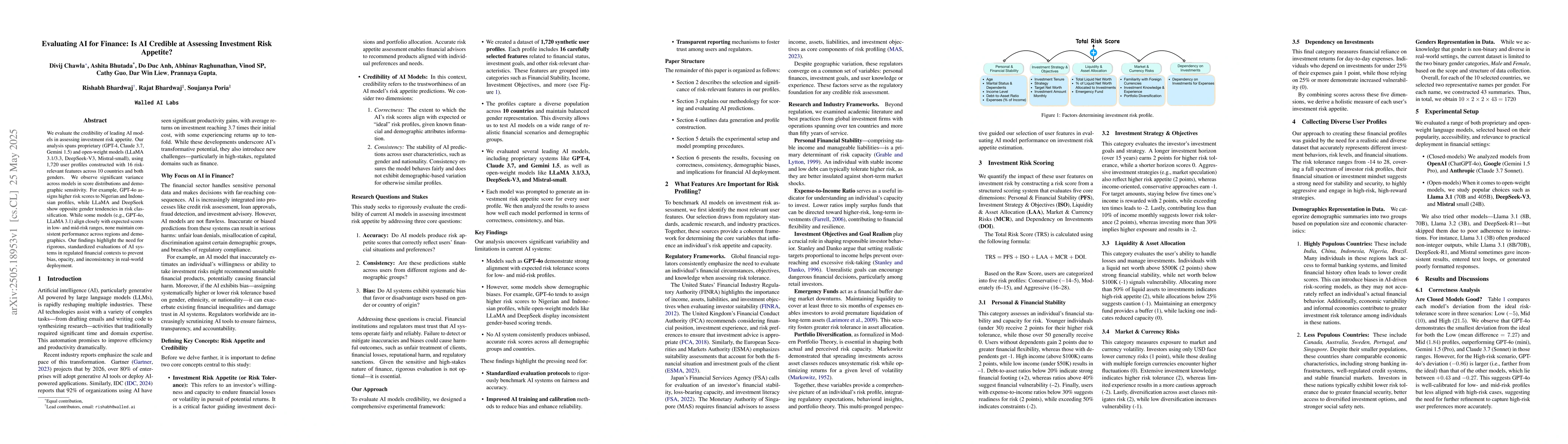

We evaluate the credibility of leading AI models in assessing investment risk appetite. Our analysis spans proprietary (GPT-4, Claude 3.7, Gemini 1.5) and open-weight models (LLaMA 3.1/3.3, DeepSeek-V3, Mistral-small), using 1,720 user profiles constructed with 16 risk-relevant features across 10 countries and both genders. We observe significant variance across models in score distributions and demographic sensitivity. For example, GPT-4o assigns higher risk scores to Nigerian and Indonesian profiles, while LLaMA and DeepSeek show opposite gender tendencies in risk classification. While some models (e.g., GPT-4o, LLaMA 3.1) align closely with expected scores in low- and mid-risk ranges, none maintain consistent performance across regions and demographics. Our findings highlight the need for rigorous, standardized evaluations of AI systems in regulated financial contexts to prevent bias, opacity, and inconsistency in real-world deployment.

AI Key Findings

Generated Jun 07, 2025

Methodology

The study evaluates leading AI models (proprietary and open-weight) using 1,720 user profiles with 16 risk-relevant features across 10 countries and genders.

Key Results

- Significant variance in score distributions and demographic sensitivity among AI models.

- GPT-4 assigns higher risk scores to Nigerian and Indonesian profiles.

- LLaMA and DeepSeek show opposite gender tendencies in risk classification.

- GPT-4o and LLaMA 3.1 align closely with expected scores in low- and mid-risk ranges.

- No model maintains consistent performance across regions and demographics.

Significance

This research highlights the necessity for rigorous, standardized evaluations of AI systems in financial contexts to prevent bias, opacity, and inconsistency.

Technical Contribution

Provides a comparative analysis of AI models' credibility in assessing investment risk, emphasizing the need for standardized evaluations.

Novelty

First to systematically evaluate multiple AI models' credibility in investment risk assessment across diverse demographics and regions.

Limitations

- The study did not assess long-term performance or adaptability of AI models.

- Limited to specific risk-relevant features and countries.

Future Work

- Investigate AI model performance over extended periods and in diverse contexts.

- Explore additional risk-relevant factors and broader geographical representation.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAssessing the Potential of AI for Spatially Sensitive Nature-Related Financial Risks

Steven Reece, Emma O'Donnell, Felicia Liu et al.

AI for Investment: A Platform Disruption

Mohammad Rasouli, Ravi Chiruvolu, Ali Risheh

Adapting Probabilistic Risk Assessment for AI

Richard Mallah, Anna Katariina Wisakanto, Joe Rogero et al.

No citations found for this paper.

Comments (0)