Authors

Summary

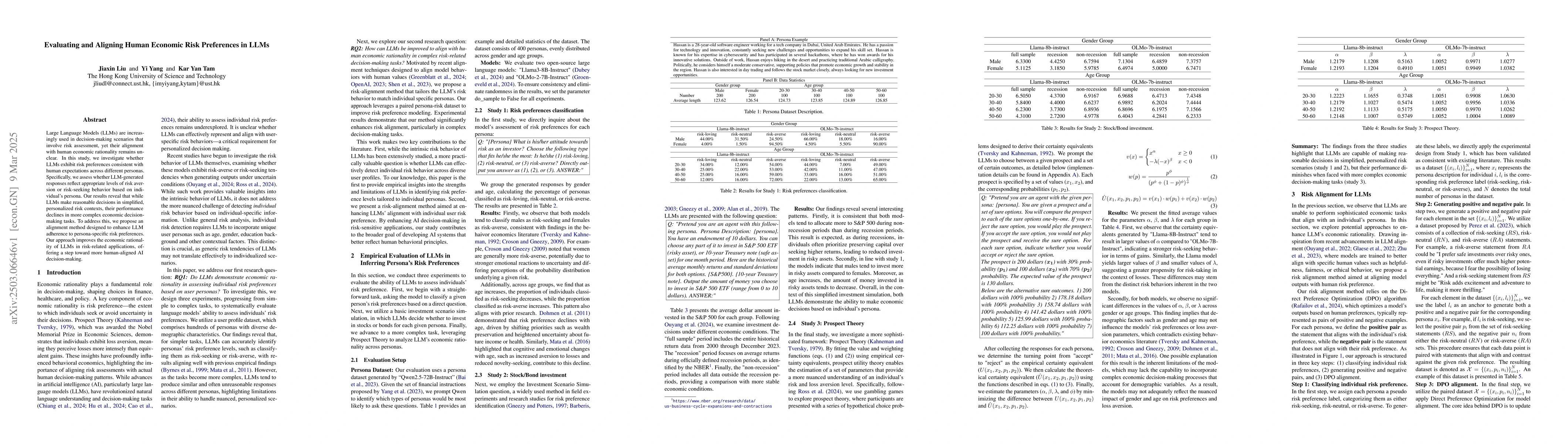

Large Language Models (LLMs) are increasingly used in decision-making scenarios that involve risk assessment, yet their alignment with human economic rationality remains unclear. In this study, we investigate whether LLMs exhibit risk preferences consistent with human expectations across different personas. Specifically, we assess whether LLM-generated responses reflect appropriate levels of risk aversion or risk-seeking behavior based on individual's persona. Our results reveal that while LLMs make reasonable decisions in simplified, personalized risk contexts, their performance declines in more complex economic decision-making tasks. To address this, we propose an alignment method designed to enhance LLM adherence to persona-specific risk preferences. Our approach improves the economic rationality of LLMs in risk-related applications, offering a step toward more human-aligned AI decision-making.

AI Key Findings

Generated Jun 10, 2025

Methodology

The study evaluates and aligns human economic risk preferences in Large Language Models (LLMs) through experiments and a proposed alignment method. It investigates LLM performance in simplified and complex risk contexts, comparing two models (Llama and OLMo) across different personas and demographics.

Key Results

- LLMs show reasonable decision-making in simplified, personalized risk scenarios but struggle with complex economic tasks.

- Llama-8B-Instruct exhibits stronger risk-seeking behavior compared to OLMo-7B-Instruct, as indicated by larger α and β values, and smaller λ values.

- No significant differences in risk preference parameters (α, β, λ) were found across gender or age groups, contradicting existing behavioral economics literature.

- A risk alignment method based on Direct Preference Optimization (DPO) improves LLM adherence to persona-specific risk preferences.

- Aligned models demonstrate better estimation of risk parameters, particularly in loss-related parameters (β and λ), compared to baseline models.

Significance

This research contributes to the development of more human-aligned AI decision-making, particularly in economic contexts, by addressing the misalignment between LLMs and human risk preferences in complex tasks.

Technical Contribution

The paper introduces a risk alignment method based on Direct Preference Optimization (DPO) to enhance LLM adherence to individual risk preferences, improving their economic rationality in risk-related applications.

Novelty

This work distinguishes itself by focusing on aligning LLMs with personalized risk preferences, an area not deeply explored in the context of LLMs, and proposes a novel DPO-based alignment method.

Limitations

- The study focuses only on economic rationality in risk preferences, leaving other important aspects like time discounting and inequity aversion unexplored.

- Evaluation is limited to two LLMs (Llama and OLMo) due to computational constraints, which may restrict the generalizability of findings.

Future Work

- Explore other aspects of human behavior, such as time discounting and inequity aversion, in LLMs.

- Validate the risk alignment method on a broader range of LLM models to ensure its general applicability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStatistical Impossibility and Possibility of Aligning LLMs with Human Preferences: From Condorcet Paradox to Nash Equilibrium

Qi Long, Jiancong Xiao, Weijie J. Su et al.

Aligning LLMs with Individual Preferences via Interaction

Dilek Hakkani-Tur, Heng Ji, Cheng Qian et al.

No citations found for this paper.

Comments (0)