Authors

Summary

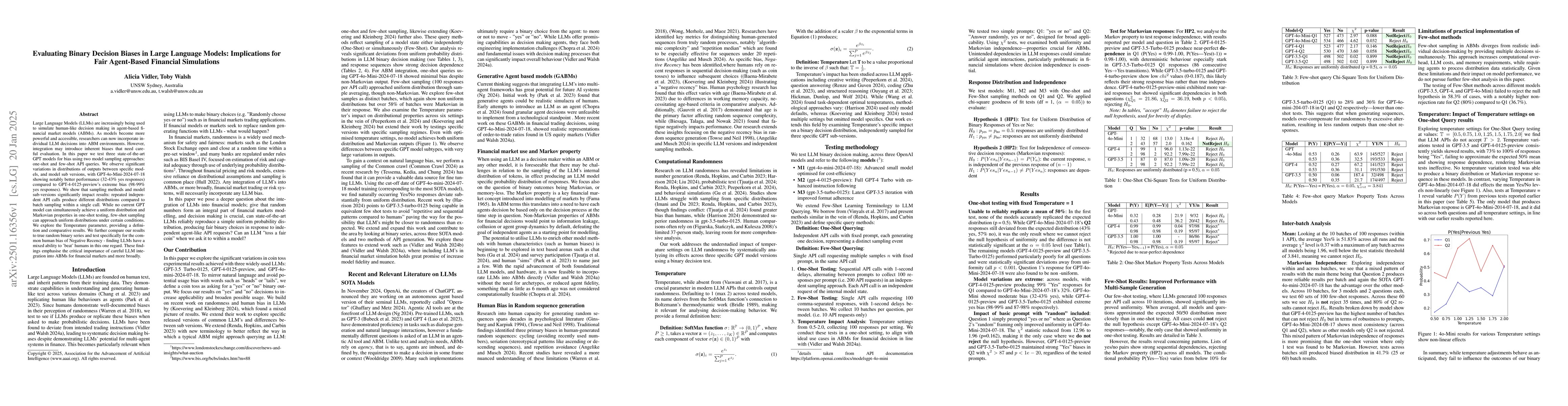

Large Language Models (LLMs) are increasingly being used to simulate human-like decision making in agent-based financial market models (ABMs). As models become more powerful and accessible, researchers can now incorporate individual LLM decisions into ABM environments. However, integration may introduce inherent biases that need careful evaluation. In this paper we test three state-of-the-art GPT models for bias using two model sampling approaches: one-shot and few-shot API queries. We observe significant variations in distributions of outputs between specific models, and model sub versions, with GPT-4o-Mini-2024-07-18 showing notably better performance (32-43% yes responses) compared to GPT-4-0125-preview's extreme bias (98-99% yes responses). We show that sampling methods and model sub-versions significantly impact results: repeated independent API calls produce different distributions compared to batch sampling within a single call. While no current GPT model can simultaneously achieve a uniform distribution and Markovian properties in one-shot testing, few-shot sampling can approach uniform distributions under certain conditions. We explore the Temperature parameter, providing a definition and comparative results. We further compare our results to true random binary series and test specifically for the common human bias of Negative Recency - finding LLMs have a mixed ability to 'beat' humans in this one regard. These findings emphasise the critical importance of careful LLM integration into ABMs for financial markets and more broadly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvaluating Company-specific Biases in Financial Sentiment Analysis using Large Language Models

Masanori Hirano, Kei Nakagawa, Yugo Fujimoto

INVESTORBENCH: A Benchmark for Financial Decision-Making Tasks with LLM-based Agent

Jimin Huang, Qianqian Xie, Yangyang Yu et al.

MindScope: Exploring cognitive biases in large language models through Multi-Agent Systems

Liang He, Xingjiao Wu, Yanhong Bai et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)