Summary

Decentralised Autonomous Organisations (DAOs) automate governance and resource allocation through smart contracts, aiming to shift decision-making to distributed token holders. However, many DAOs face sustainability challenges linked to limited user participation, concentrated voting power, and technical design constraints. This paper addresses these issues by identifying research gaps in DAO evaluation and introducing a framework of Key Performance Indicators (KPIs) that capture governance efficiency, financial robustness, decentralisation, and community engagement. We apply the framework to a custom-built dataset of real-world DAOs constructed from on-chain data and analysed using non-parametric methods. The results reveal recurring governance patterns, including low participation rates and high proposer concentration, which may undermine long-term viability. The proposed KPIs offer a replicable, data-driven method for assessing DAO governance structures and identifying potential areas for improvement. These findings support a multidimensional approach to evaluating decentralised systems and provide practical tools for researchers and practitioners working to improve the resilience and effectiveness of DAO-based governance models.

AI Key Findings

Generated Jun 09, 2025

Methodology

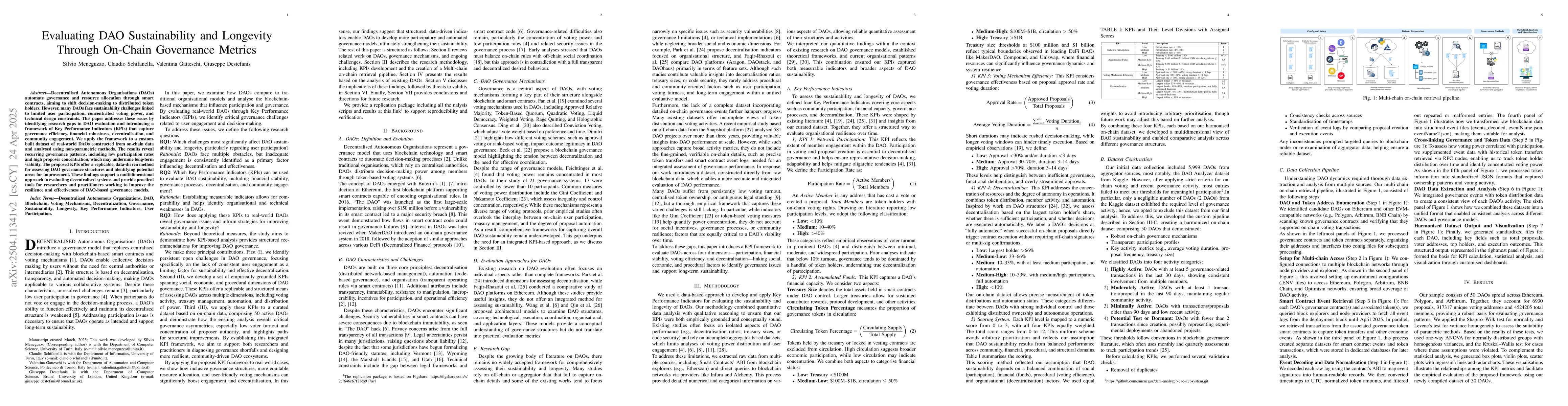

This study utilized a custom on-chain dataset of 50 DAO governance structures, constructed from Ethereum, Polygon, and Arbitrum networks, to introduce a framework of Key Performance Indicators (KPIs) for evaluating DAO sustainability and longevity through on-chain governance metrics.

Key Results

- Recurring governance patterns, including low participation rates and high proposer concentration, were identified that may undermine long-term DAO viability.

- Four KPIs were proposed: Network Participation, Accumulated Funds, Voting Mechanism Efficiency, and Decentralisation, each with distinct categories and thresholds.

- Significant differences were found in KPI categories using non-parametric tests, indicating that DAO sustainability results from balanced performance across community, financial, procedural, and structural domains.

- A weak and statistically non-significant correlation was observed between the largest holder's percentage and participation rate, suggesting that concentrated token ownership does not necessarily reduce member activity.

- DAOs with more balanced profiles across KPIs tend to achieve higher composite scores, indicating more resilient governance structures.

Significance

This research is important as it provides a data-driven, replicable method for assessing DAO governance structures, offering practical tools for researchers and practitioners to improve DAO-based governance models' resilience and effectiveness.

Technical Contribution

The paper introduces a comprehensive framework of KPIs for evaluating DAO governance, combining on-chain data analysis with empirical patterns to identify sustainability indicators.

Novelty

This work distinguishes itself by quantifying the relationships between treasury size, participation rates, and voting structure with sustainability indicators, offering a multi-dimensional perspective on DAO governance sustainability.

Limitations

- The dataset only included DAO governance structures with active on-chain activity, excluding those with limited or off-chain governance.

- The analysis provides a snapshot as of April 2025; DAO structures and participation trends may evolve over time.

Future Work

- Incorporate longitudinal analysis to observe governance changes over time.

- Expand coverage to off-chain processes through community forum and governance platform data integration.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBalancing Security and Liquidity: A Time-Weighted Snapshot Framework for DAO Governance Voting

Zayn Wang, Frank Pu, Vinci Cheung et al.

No citations found for this paper.

Comments (0)