Summary

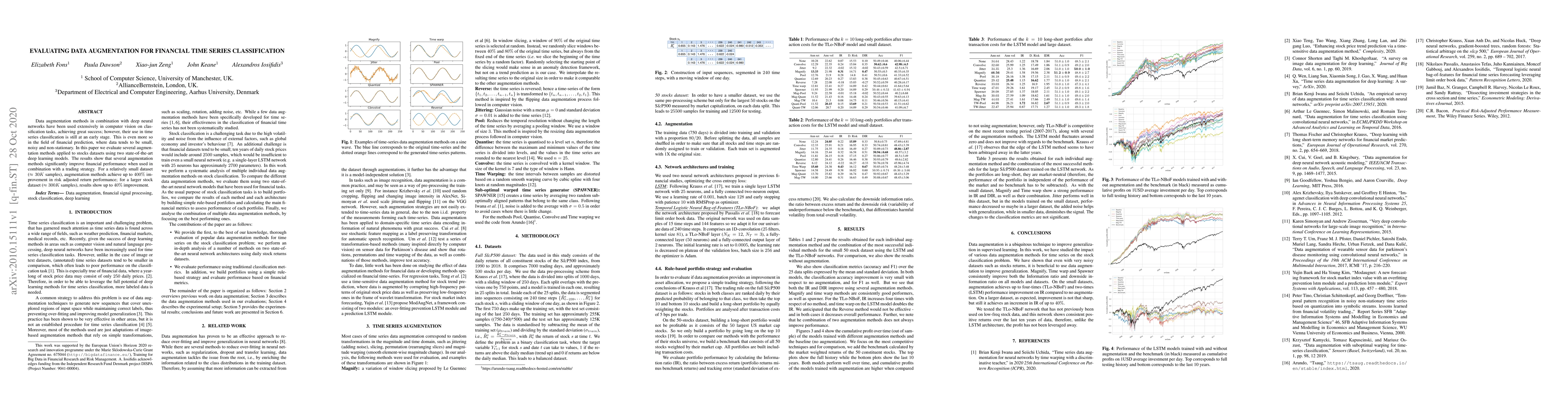

Data augmentation methods in combination with deep neural networks have been used extensively in computer vision on classification tasks, achieving great success; however, their use in time series classification is still at an early stage. This is even more so in the field of financial prediction, where data tends to be small, noisy and non-stationary. In this paper we evaluate several augmentation methods applied to stocks datasets using two state-of-the-art deep learning models. The results show that several augmentation methods significantly improve financial performance when used in combination with a trading strategy. For a relatively small dataset ($\approx30K$ samples), augmentation methods achieve up to $400\%$ improvement in risk adjusted return performance; for a larger stock dataset ($\approx300K$ samples), results show up to $40\%$ improvement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersData Augmentation for Multivariate Time Series Classification: An Experimental Study

Romain Ilbert, Thai V. Hoang, Zonghua Zhang

Robust Augmentation for Multivariate Time Series Classification

Hong Yang, Travis Desell

Financial Time Series Data Augmentation with Generative Adversarial Networks and Extended Intertemporal Return Plots

Ankit Shah, Justin Hellermann, Qinzhuan Qian

| Title | Authors | Year | Actions |

|---|

Comments (0)