Summary

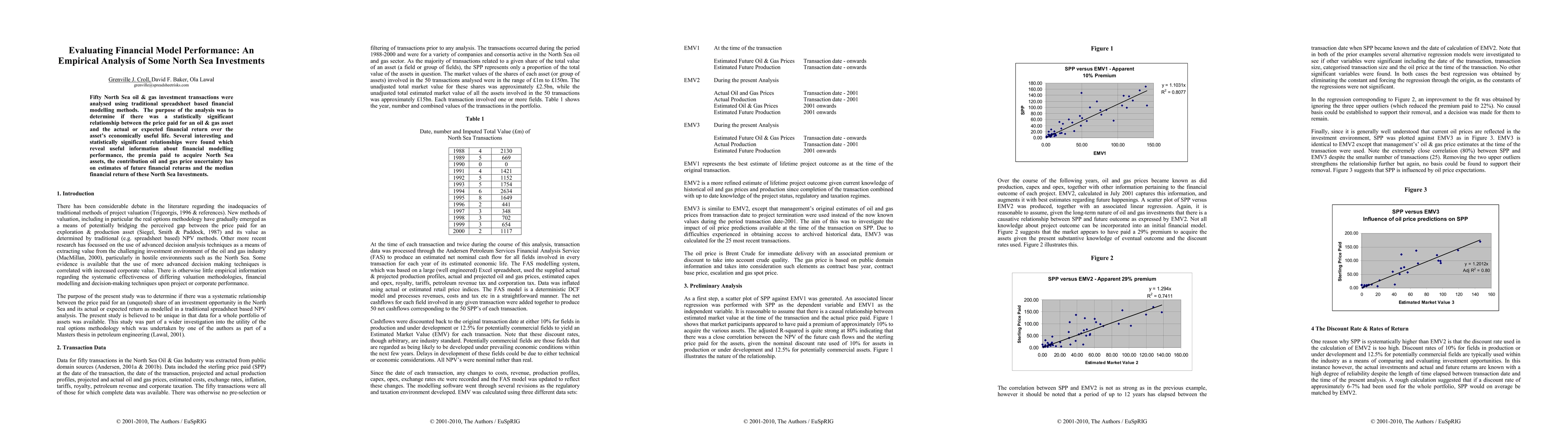

Fifty North Sea oil & gas investment transactions were analysed using traditional spreadsheet based financial modelling methods. The purpose of the analysis was to determine if there was a statistically significant relationship between the price paid for an oil & gas asset and the actual or expected financial return over the asset's economically useful life. Several interesting and statistically significant relationships were found which reveal useful information about financial modelling performance, the premia paid to acquire North Sea assets, the contribution oil and gas price uncertainty has on estimates of future financial returns and the median financial return of these North Sea Investments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPowering Europe with North Sea Offshore Wind: The Impact of Hydrogen Investments on Grid Infrastructure and Power Prices

Pedro Crespo del Granado, Goran Durakovic, Asgeir Tomasgard

Measuring the performance of investments in information security startups: An empirical analysis by cybersecurity sectors using Crunchbase data

Mathias Humbert, Loïc Maréchal, Dimitri Percia David et al.

Bayesian Optimization of ESG Financial Investments

Eduardo C. Garrido-Merchán, Gabriel González Piris, Maria Coronado Vaca

Evaluating Company-specific Biases in Financial Sentiment Analysis using Large Language Models

Masanori Hirano, Kei Nakagawa, Yugo Fujimoto

| Title | Authors | Year | Actions |

|---|

Comments (0)