Authors

Summary

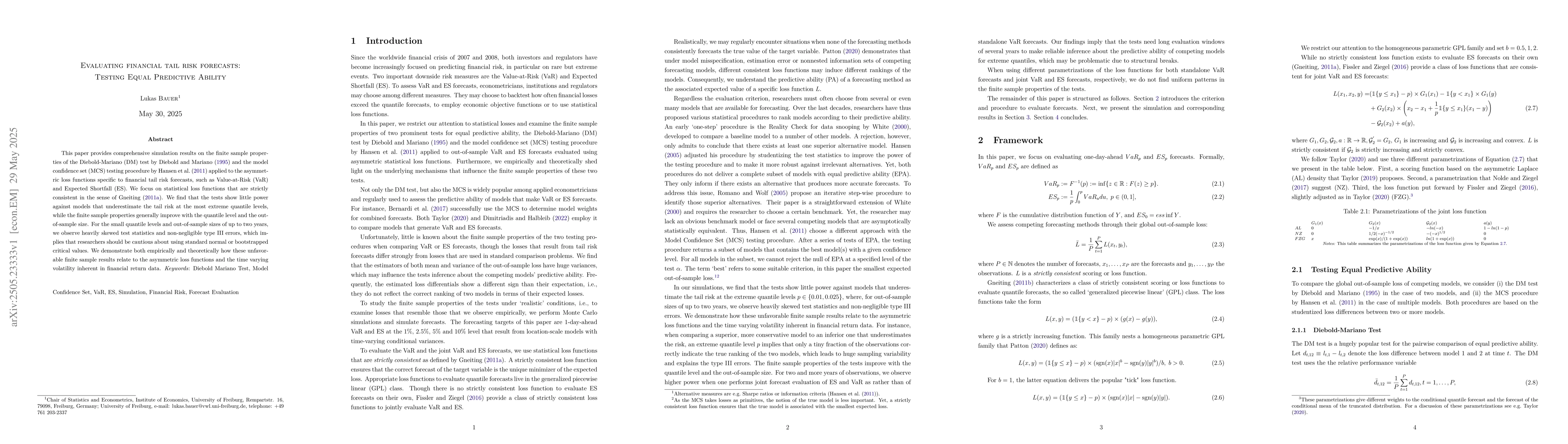

This paper provides comprehensive simulation results on the finite sample properties of the Diebold-Mariano (DM) test by Diebold and Mariano (1995) and the model confidence set (MCS) testing procedure by Hansen et al. (2011) applied to the asymmetric loss functions specific to financial tail risk forecasts, such as Value-at-Risk (VaR) and Expected Shortfall (ES). We focus on statistical loss functions that are strictly consistent in the sense of Gneiting (2011a). We find that the tests show little power against models that underestimate the tail risk at the most extreme quantile levels, while the finite sample properties generally improve with the quantile level and the out-of-sample size. For the small quantile levels and out-of-sample sizes of up to two years, we observe heavily skewed test statistics and non-negligible type III errors, which implies that researchers should be cautious about using standard normal or bootstrapped critical values. We demonstrate both empirically and theoretically how these unfavorable finite sample results relate to the asymmetric loss functions and the time varying volatility inherent in financial return data.

AI Key Findings

Generated Jun 05, 2025

Methodology

This research employs comprehensive simulation results to analyze the finite sample properties of the Diebold-Mariano (DM) test and the Model Confidence Set (MCS) testing procedure applied to asymmetric loss functions specific to financial tail risk forecasts, such as Value-at-Risk (VaR) and Expected Shortfall (ES).

Key Results

- The DM test and MCS show little power against models that underestimate tail risk at extreme quantile levels.

- Finite sample properties improve with quantile level and out-of-sample size.

- Small quantile levels and out-of-sample sizes up to two years exhibit heavily skewed test statistics and non-negligible Type III errors.

- The unfavorable finite sample results relate to asymmetric loss functions and time-varying volatility inherent in financial return data.

- Power improves for two or more years when joint forecasts of ES and VaR are evaluated rather than standalone VaR forecasts.

Significance

The study highlights the need for reliable inference about the predictive accuracy of competing models for extreme quantiles, which typically requires long evaluation windows to avoid structural breaks. It also suggests that the MCS test's potency is often much higher than 1-α, making it safe to use larger α values in applied work to observe power.

Technical Contribution

The paper provides detailed simulation results and analysis of the DM test and MCS for evaluating financial tail risk forecasts, contributing to the understanding of their finite sample properties under asymmetric loss functions.

Novelty

This work distinguishes itself by examining the finite sample properties of the DM test and MCS specifically for tail risk forecasts, revealing critical insights into their performance and limitations in detecting overly optimistic VaR models at extreme quantiles.

Limitations

- The research focuses on specific loss functions and does not explore other potential loss measures.

- The findings may not generalize to all financial markets or asset classes.

Future Work

- Explore if conditional forecast evaluation along the lines of Giacomini and White (2006) shows better discriminative ability, particularly relevant under misspecification and from a regulatory perspective.

- Investigate finite sample corrections for variance estimates to mitigate large Type III errors for shorter out-of-sample sizes.

Paper Details

PDF Preview

Similar Papers

Found 4 papersTesting Clustered Equal Predictive Ability with Unknown Clusters

Giovanni Urga, Oguzhan Akgun, Alain Pirotte et al.

Equal Predictive Ability Tests Based on Panel Data with Applications to OECD and IMF Forecasts

Giovanni Urga, Oguzhan Akgun, Alain Pirotte et al.

Adaptive combinations of tail-risk forecasts

Alessandra Amendola, Vincenzo Candila, Antonio Naimoli et al.

No citations found for this paper.

Comments (0)