Summary

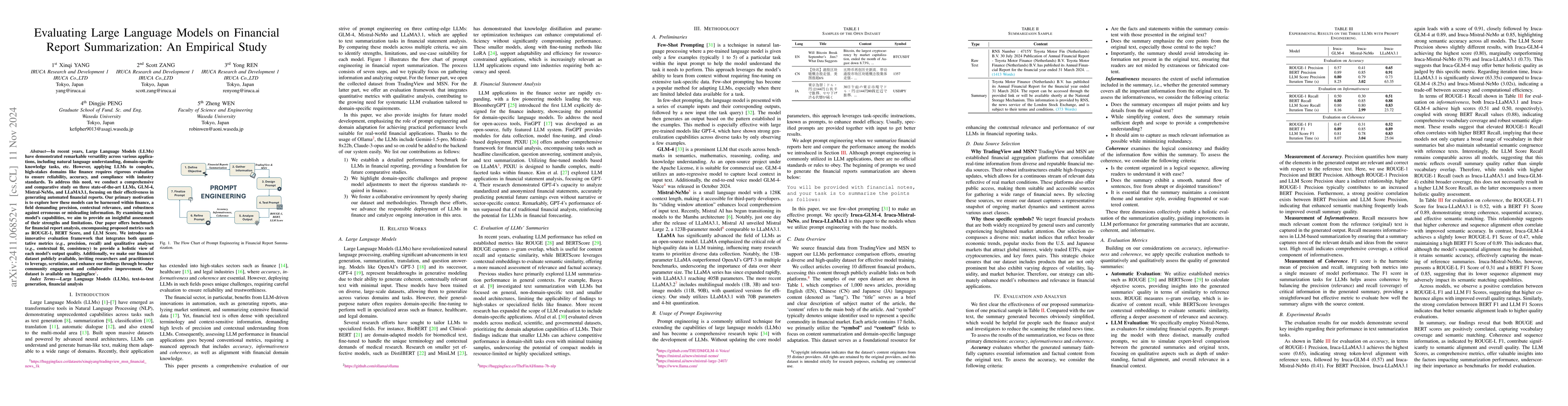

In recent years, Large Language Models (LLMs) have demonstrated remarkable versatility across various applications, including natural language understanding, domain-specific knowledge tasks, etc. However, applying LLMs to complex, high-stakes domains like finance requires rigorous evaluation to ensure reliability, accuracy, and compliance with industry standards. To address this need, we conduct a comprehensive and comparative study on three state-of-the-art LLMs, GLM-4, Mistral-NeMo, and LLaMA3.1, focusing on their effectiveness in generating automated financial reports. Our primary motivation is to explore how these models can be harnessed within finance, a field demanding precision, contextual relevance, and robustness against erroneous or misleading information. By examining each model's capabilities, we aim to provide an insightful assessment of their strengths and limitations. Our paper offers benchmarks for financial report analysis, encompassing proposed metrics such as ROUGE-1, BERT Score, and LLM Score. We introduce an innovative evaluation framework that integrates both quantitative metrics (e.g., precision, recall) and qualitative analyses (e.g., contextual fit, consistency) to provide a holistic view of each model's output quality. Additionally, we make our financial dataset publicly available, inviting researchers and practitioners to leverage, scrutinize, and enhance our findings through broader community engagement and collaborative improvement. Our dataset is available on huggingface.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvaluating Large Language Models (LLMs) in Financial NLP: A Comparative Study on Financial Report Analysis

Md Talha Mohsin

An Empirical Study of Many-to-Many Summarization with Large Language Models

Jie Zhou, Jiarong Xu, Fandong Meng et al.

Crash Report Enhancement with Large Language Models: An Empirical Study

Zeyang Ma, Dong Jae Kim, Md Nakhla Rafi et al.

Large Language Models for Code Summarization

Balázs Szalontai, Gergő Szalay, Tamás Márton et al.

No citations found for this paper.

Comments (0)