Summary

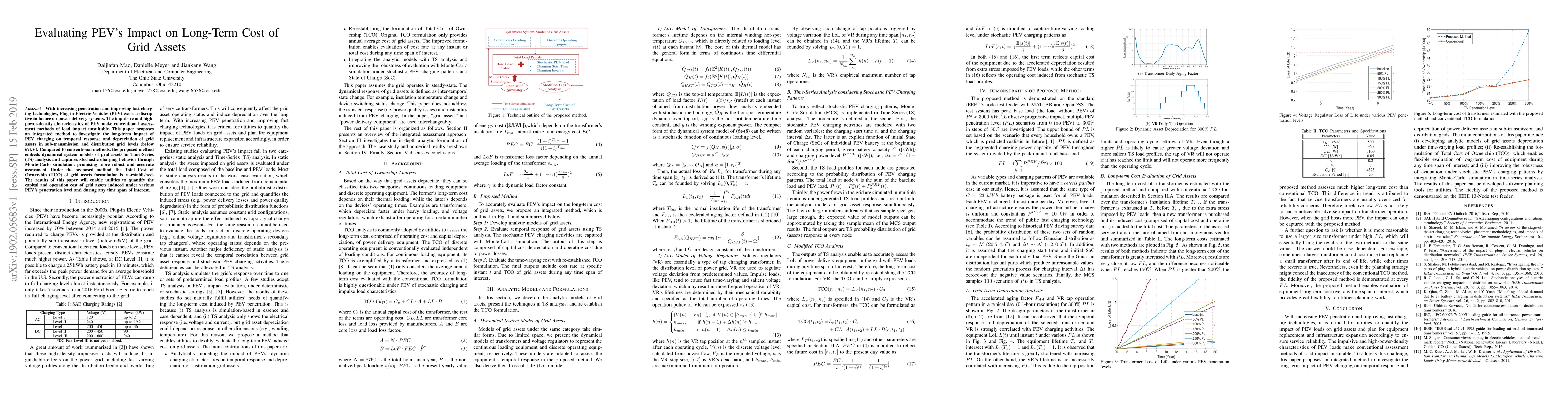

With increasing penetration and improving fast charging technologies, Plug-in Electric Vehicles (PEV) exert a disruptive influence on power delivery systems. The impulsive and high power-density characteristics of PEV make conventional assessment methods of load impact unsuitable. This paper proposes an integrated method to investigate the long-term impact of PEV charging on temporal response and depreciation of grid assets in sub-transmission and distribution grid levels (below 69kV). Compared to conventional methods, the proposed method embeds dynamical system models of grid assets in Time-Series (TS) analysis and captures stochastic charging behavior through Monte-Carlo simulation, promising more robust and accurate assessment. Under the proposed method, the Total Cost of Ownership (TCO) of grid assets formulation is re-established. The results of this paper will enable utilities to quantify the capital and operation cost of grid assets induced under various PEV penetration level and during any time span of interest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLong-term Value of Flexibility from Flexible Assets in Building Operation

Magnus Korpås, Kasper Emil Thorvaldsen, Hossein Farahmand

| Title | Authors | Year | Actions |

|---|

Comments (0)