Authors

Summary

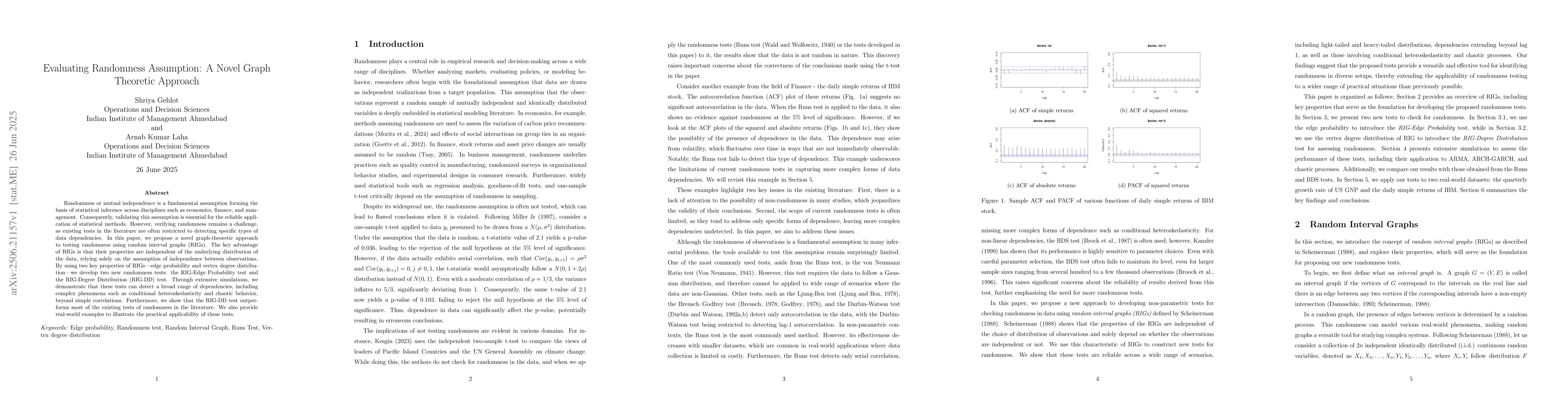

Randomness or mutual independence is a fundamental assumption forming the basis of statistical inference across disciplines such as economics, finance, and management. Consequently, validating this assumption is essential for the reliable application of statistical methods. However, verifying randomness remains a challenge, as existing tests in the literature are often restricted to detecting specific types of data dependencies. In this paper, we propose a novel graph-theoretic approach to testing randomness using random interval graphs (RIGs). The key advantage of RIGs is that their properties are independent of the underlying distribution of the data, relying solely on the assumption of independence between observations. By using two key properties of RIGs-edge probability and vertex degree distribution-we develop two new randomness tests: the RIG-Edge Probability test and the RIG-Degree Distribution (RIG-DD) test. Through extensive simulations, we demonstrate that these tests can detect a broad range of dependencies, including complex phenomena such as conditional heteroskedasticity and chaotic behavior, beyond simple correlations. Furthermore, we show that the RIG-DD test outperforms most of the existing tests of randomness in the literature. We also provide real-world examples to illustrate the practical applicability of these tests.

AI Key Findings

Generated Sep 05, 2025

Methodology

The proposed tests were developed using the properties of RIG, which are independent of the underlying distribution of observations and rely solely on the randomness of data.

Key Results

- The RIG-Edge Probability (RIG-EP) test consistently outperforms both the Runs and BDS tests across a range of scenarios.

- Both RIG-EP and RIG-Degree Distribution (RIG-DD) tests successfully detect dependencies beyond simple correlation, including conditional heteroskedasticity and chaotic processes.

- The RIG-DD test is more robust to outliers and has better performance in detecting complex patterns of dependence.

Significance

This research contributes to the development of new statistical methods for testing independence in financial time series, which is essential for understanding and modeling complex economic phenomena.

Technical Contribution

The development of RIG-EP and RIG-DD tests provides a new framework for testing independence in financial time series, which can help improve our understanding of complex economic phenomena.

Novelty

This research introduces a new approach to testing independence that is based on the properties of RIG, which offers a more robust and efficient alternative to existing methods.

Limitations

- The proposed tests may not be suitable for all types of data or distributions.

- Further research is needed to fully explore the performance of RIG-EP and RIG-DD tests under various conditions.

Future Work

- Developing more advanced versions of RIG-EP and RIG-DD tests that can handle larger datasets and more complex dependencies.

- Investigating the application of RIG-EP and RIG-DD tests to other fields beyond finance, such as biology and social sciences.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImprecision in Martingale-Theoretic Prequential Randomness

Gert de Cooman, Floris Persiau

Graph-theoretic approach to dimension witnessing

Kishor Bharti, Adán Cabello, Leong-Chuan Kwek et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)