Summary

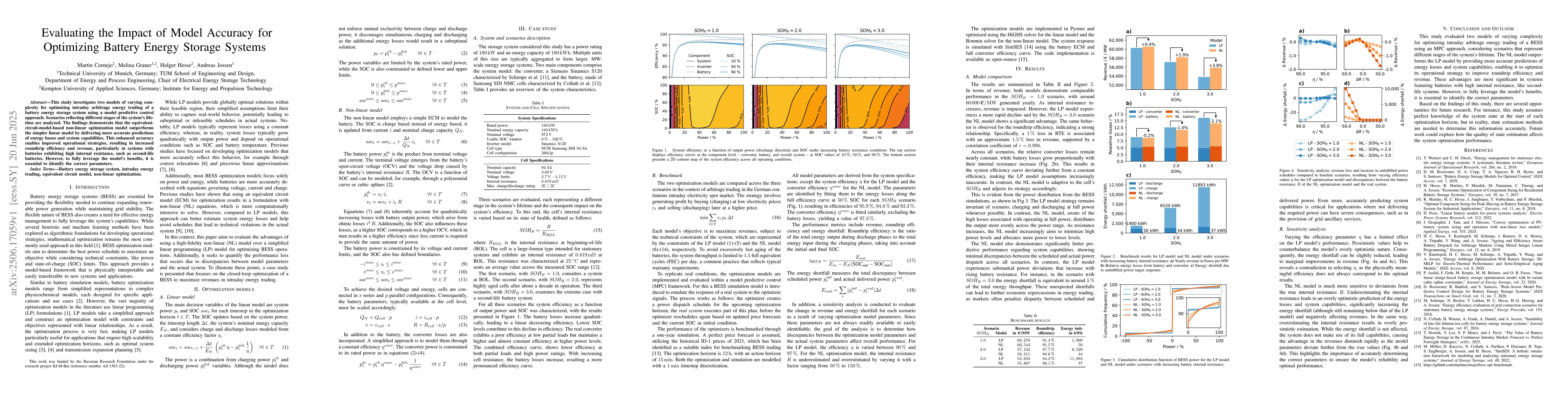

This study investigates two models of varying complexity for optimizing intraday arbitrage energy trading of a battery energy storage system using a model predictive control approach. Scenarios reflecting different stages of the system's lifetime are analyzed. The findings demonstrate that the equivalent-circuit-model-based non-linear optimization model outperforms the simpler linear model by delivering more accurate predictions of energy losses and system capabilities. This enhanced accuracy enables improved operational strategies, resulting in increased roundtrip efficiency and revenue, particularly in systems with batteries exhibiting high internal resistance, such as second-life batteries. However, to fully leverage the model's benefits, it is essential to identify the correct parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom Balance to Breach: Cyber Threats to Battery Energy Storage Systems

Mikael Asplund, Frans Öhrström, Joakim Oscarsson et al.

Interpretable Deep Reinforcement Learning for Optimizing Heterogeneous Energy Storage Systems

Yang Tang, Zhaoyang Dong, Ke Meng et al.

Weather-Driven Priority Charging for Battery Storage Systems in Hybrid Renewable Energy Grid

Dhrumil Bhatt, Siddharth Penumatsa, Nirbhay Singhal

| Title | Authors | Year | Actions |

|---|

Comments (0)