Summary

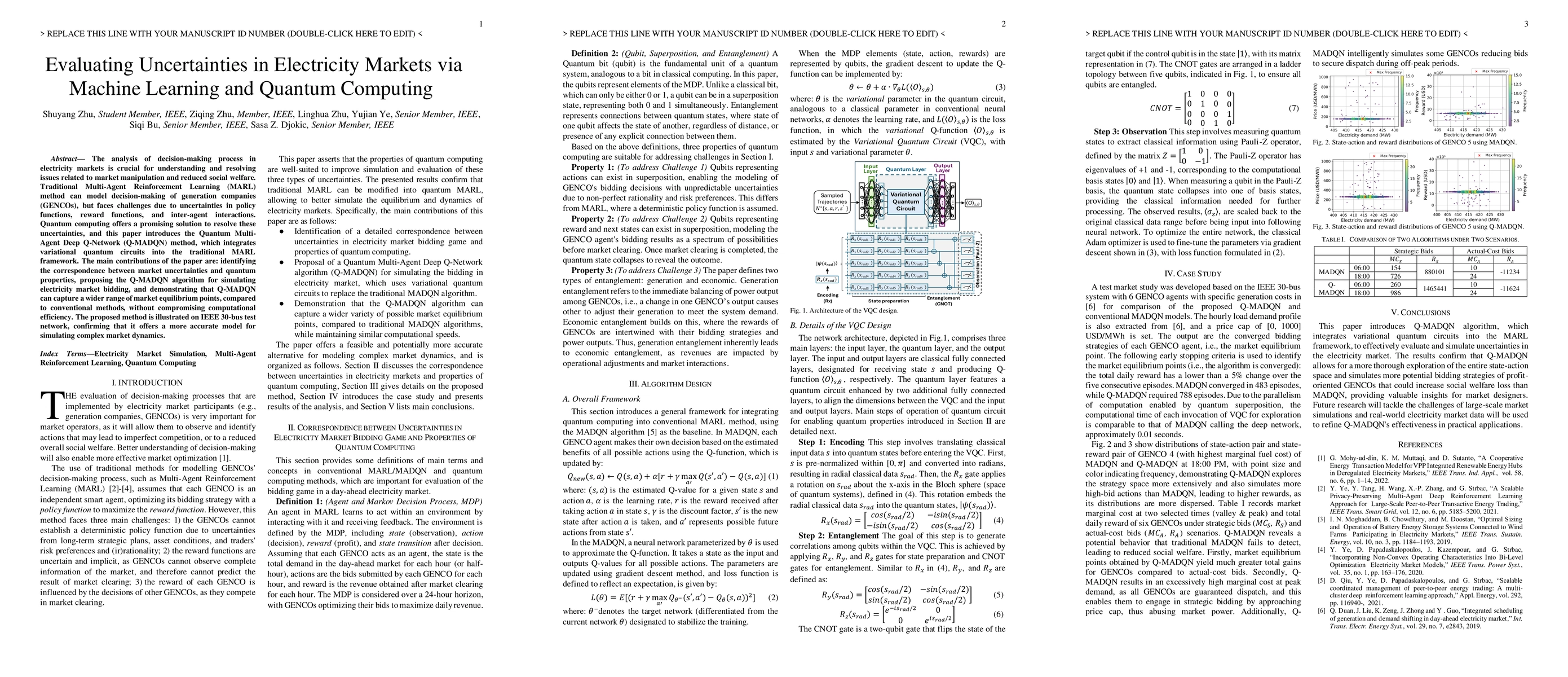

The analysis of decision-making process in electricity markets is crucial for understanding and resolving issues related to market manipulation and reduced social welfare. Traditional Multi-Agent Reinforcement Learning (MARL) method can model decision-making of generation companies (GENCOs), but faces challenges due to uncertainties in policy functions, reward functions, and inter-agent interactions. Quantum computing offers a promising solution to resolve these uncertainties, and this paper introduces the Quantum Multi-Agent Deep Q-Network (Q-MADQN) method, which integrates variational quantum circuits into the traditional MARL framework. The main contributions of the paper are: identifying the correspondence between market uncertainties and quantum properties, proposing the Q-MADQN algorithm for simulating electricity market bidding, and demonstrating that Q-MADQN allows for a more thorough exploration and simulates more potential bidding strategies of profit-oriented GENCOs, compared to conventional methods, without compromising computational efficiency. The proposed method is illustrated on IEEE 30-bus test network, confirming that it offers a more accurate model for simulating complex market dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Machine Learning Approach for Prosumer Management in Intraday Electricity Markets

Mohammad Reza Hesamzadeh, Saeed Mohammadi

Bilevel Model for Electricity Market Mechanism Optimisation via Quantum Computing Enhanced Reinforcement Learning

Ziqing Zhu, Shuyang Zhu

Quantum Machine Learning: An Interplay Between Quantum Computing and Machine Learning

Samuel Yen-Chi Chen, Pin-Yu Chen, Jun Qi et al.

No citations found for this paper.

Comments (0)