Summary

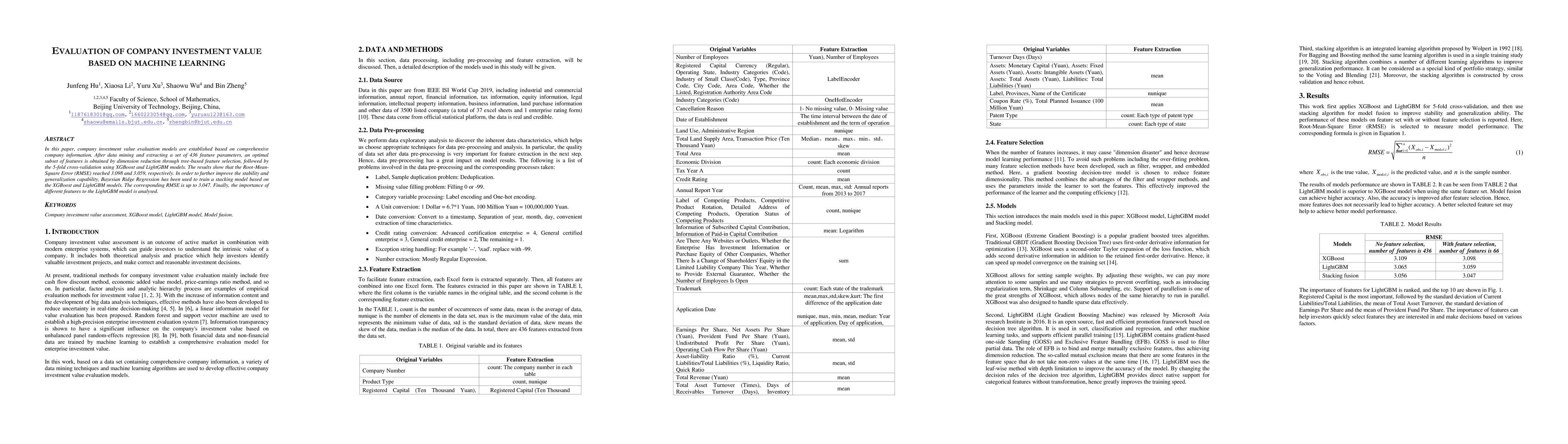

In this paper, company investment value evaluation models are established based on comprehensive company information. After data mining and extracting a set of 436 feature parameters, an optimal subset of features is obtained by dimension reduction through tree-based feature selection, followed by the 5-fold cross-validation using XGBoost and LightGBM models. The results show that the Root-Mean-Square Error (RMSE) reached 3.098 and 3.059, respectively. In order to further improve the stability and generalization capability, Bayesian Ridge Regression has been used to train a stacking model based on the XGBoost and LightGBM models. The corresponding RMSE is up to 3.047. Finally, the importance of different features to the LightGBM model is analysed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)