Summary

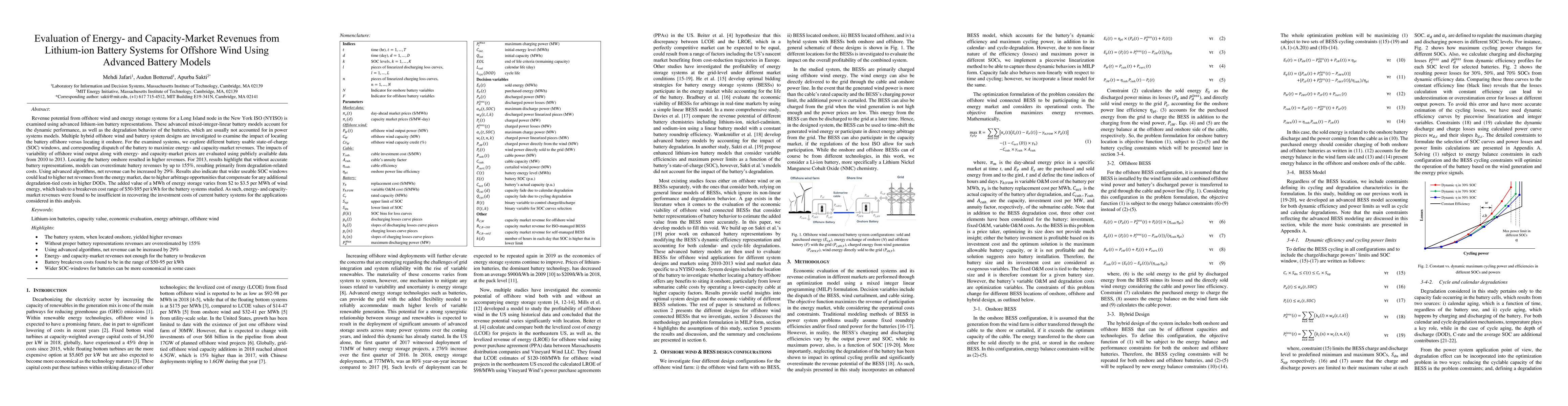

Revenue potential from offshore wind and energy storage systems for a Long Island node in the New York ISO (NYISO) is examined using advanced lithium-ion battery representations. These advanced mixed-integer-linear battery models account for the dynamic performance, as well as the degradation behavior of the batteries, which are usually not accounted for in power systems models. Multiple hybrid offshore wind and battery system designs are investigated to examine the impact of locating the battery offshore versus locating it onshore. For the examined systems, we explore different battery usable state-of-charge (SOC) windows, and corresponding dispatch of the battery to maximize energy- and capacity-market revenues. The impacts of variability of offshore wind output along with energy- and capacity-market prices are evaluated using publicly available data from 2010 to 2013. Locating the battery onshore resulted in higher revenues. For 2013, results highlight that without accurate battery representations, models can overestimate battery revenues by up to 155%, resulting primarily from degradation-related costs. Using advanced algorithms, net revenue can be increased by 29%. Results also indicate that wider useable SOC windows could lead to higher net revenues from the energy market, due to higher arbitrage opportunities that compensate for any additional degradation-tied costs in higher DODs. The added value of a MWh of energy storage varies from $2 to $3.5 per MWh of wind energy, which leads to a breakeven cost range of $50-$95 per kWh for the battery systems studied. As such, energy- and capacity-market revenues were found to be insufficient in recovering the investment costs of current battery systems for the applications considered in this analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Review of Lithium-Ion Battery Models in Techno-economic Analyses of Power Systems

Hamidreza Zareipour, Anton V. Vykhodtsev, Darren Jang et al.

Prognosis Of Lithium-Ion Battery Health with Hybrid EKF-CNN+LSTM Model Using Differential Capacity

Mohd Khair Hassan, Md Azizul Hoque, Babul Salam et al.

"Knees" in lithium-ion battery aging trajectories

Peter M. Attia, Anna G. Stefanopoulou, David Howey et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)