Summary

Valuation adjustments, collectively named XVA, play an important role in modern derivatives pricing. XVA are an exotic pricing component since they require the forward simulation of multiple risk factors in order to compute the portfolio exposure including collateral, leading to a significant model risk and computational effort, even in case of plain vanilla trades. This work analyses the most critical model risk factors, meant as those to which XVA are most sensitive, finding an acceptable compromise between accuracy and performance. This task has been conducted in a complete context including a market standard multi-curve G2++ model calibrated on real market data, both Variation Margin and ISDA-SIMM dynamic Initial Margin, different collateralization schemes, and the most common linear and non-linear interest rates derivatives. Moreover, we considered an alternative analytical approach for XVA in case of uncollateralized Swaps. We show that a crucial element is the construction of a parsimonious time grid capable of capturing all periodical spikes arising in collateralized exposure during the Margin Period of Risk. To this end, we propose a workaround to efficiently capture all spikes. Moreover, we show that there exists a parameterization which allows to obtain accurate results in a reasonable time, which is a very important feature for practical applications. In order to address the valuation uncertainty linked to the existence of a range of different parameterizations, we calculate the Model Risk AVA (Additional Valuation Adjustment) for XVA according to the provisions of the EU Prudent Valuation regulation. Finally, this work can serve as an handbook containing step-by-step instructions for the implementation of a complete, realistic and robust modelling framework of collateralized exposure and XVA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

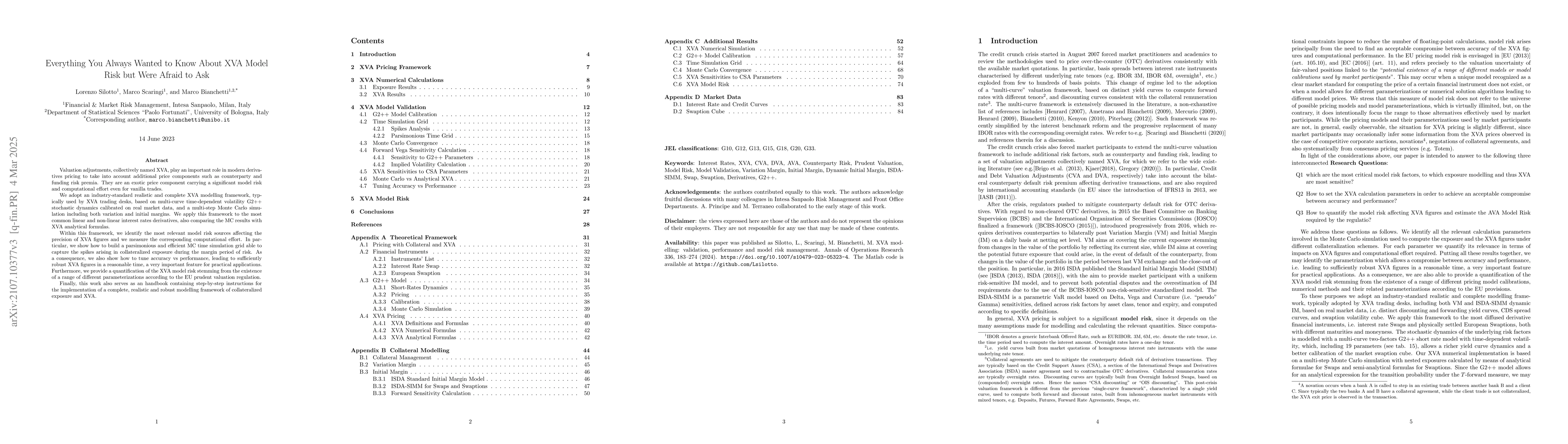

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)