Summary

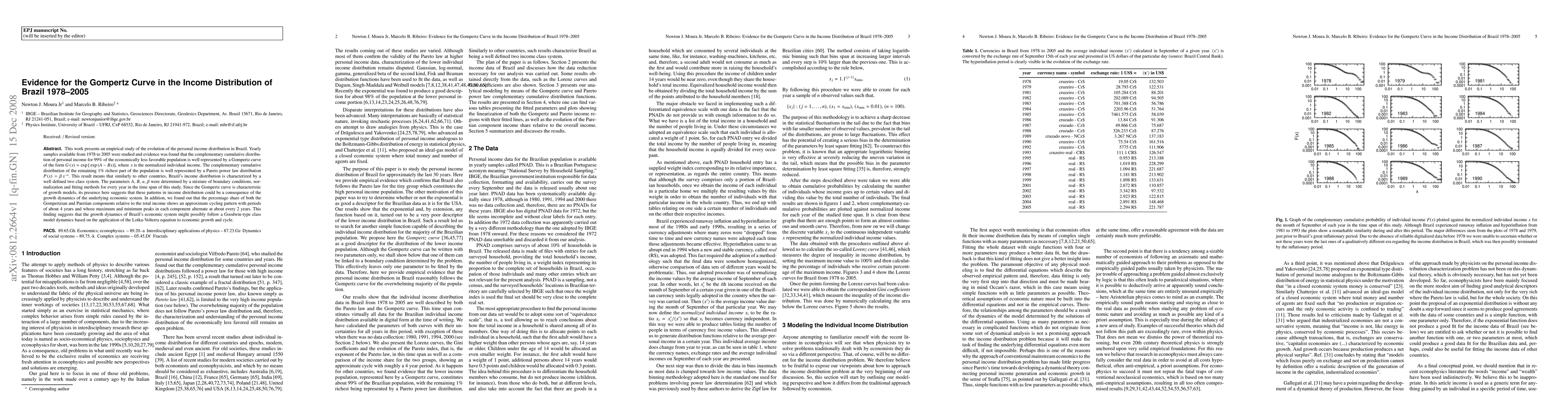

This work presents an empirical study of the evolution of the personal income distribution in Brazil. Yearly samples available from 1978 to 2005 were studied and evidence was found that the complementary cumulative distribution of personal income for 99% of the economically less favorable population is well represented by a Gompertz curve of the form $G(x)=\exp [\exp (A-Bx)]$, where $x$ is the normalized individual income. The complementary cumulative distribution of the remaining 1% richest part of the population is well represented by a Pareto power law distribution $P(x)= \beta x^{-\alpha}$. This result means that similarly to other countries, Brazil's income distribution is characterized by a well defined two class system. The parameters $A$, $B$, $\alpha$, $\beta$ were determined by a mixture of boundary conditions, normalization and fitting methods for every year in the time span of this study. Since the Gompertz curve is characteristic of growth models, its presence here suggests that these patterns in income distribution could be a consequence of the growth dynamics of the underlying economic system. In addition, we found out that the percentage share of both the Gompertzian and Paretian components relative to the total income shows an approximate cycling pattern with periods of about 4 years and whose maximum and minimum peaks in each component alternate at about every 2 years. This finding suggests that the growth dynamics of Brazil's economic system might possibly follow a Goodwin-type class model dynamics based on the application of the Lotka-Volterra equation to economic growth and cycle.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvidence for the exponential distribution of income in the USA

Victor M. Yakovenko, Adrian Dragulescu

| Title | Authors | Year | Actions |

|---|

Comments (0)