Summary

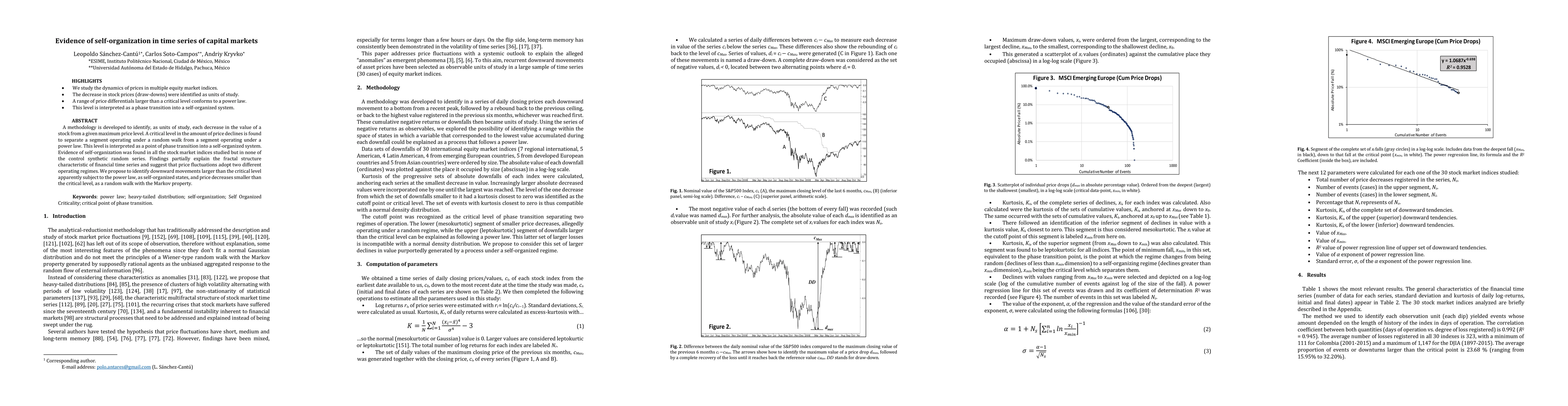

A methodology is developed to identify, as units of study, each decrease in the value of a stock from a given maximum price level. A critical level in the amount of price declines is found to separate a segment operating under a random walk from a segment operating under a power law. This level is interpreted as a point of phase transition into a self-organized system. Evidence of self-organization was found in all the stock market indices studied but in none of the control synthetic random series. Findings partially explain the fractal structure characteristic of financial time series and suggest that price fluctuations adopt two different operating regimes. We propose to identify downward movements larger than the critical level apparently subject to the power law, as self-organized states, and price decreases smaller than the critical level, as a random walk with the Markov property.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnveiling the higher-order organization of multivariate time series

Giovanni Petri, Federico Battiston, Enrico Amico et al.

No citations found for this paper.

Comments (0)