Summary

In this paper we present a novel algorithm to study the evolution of credit risk across complex multilayer networks. Pagerank-like algorithms allow for the propagation of an influence variable across single networks, and allow quantifying the risk single entities (nodes) are subject to given the connection they have to other nodes in the network. Multilayer networks, on the other hand, are networks where subset of nodes can be associated to a unique set (layer), and where edges connect elements either intra or inter networks. Our personalized PageRank algorithm for multilayer networks allows for quantifying how credit risk evolves across time and propagates through these networks. By using bipartite networks in each layer, we can quantify the risk of various components, not only the loans. We test our method in an agricultural lending dataset, and our results show how default risk is a challenging phenomenon that propagates and evolves through the network across time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

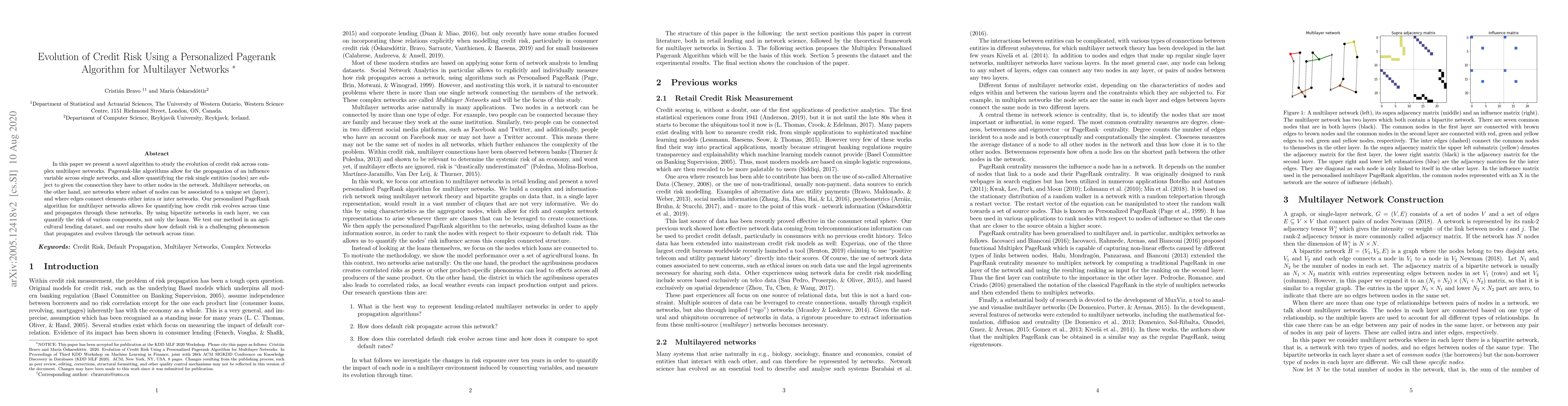

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)