Summary

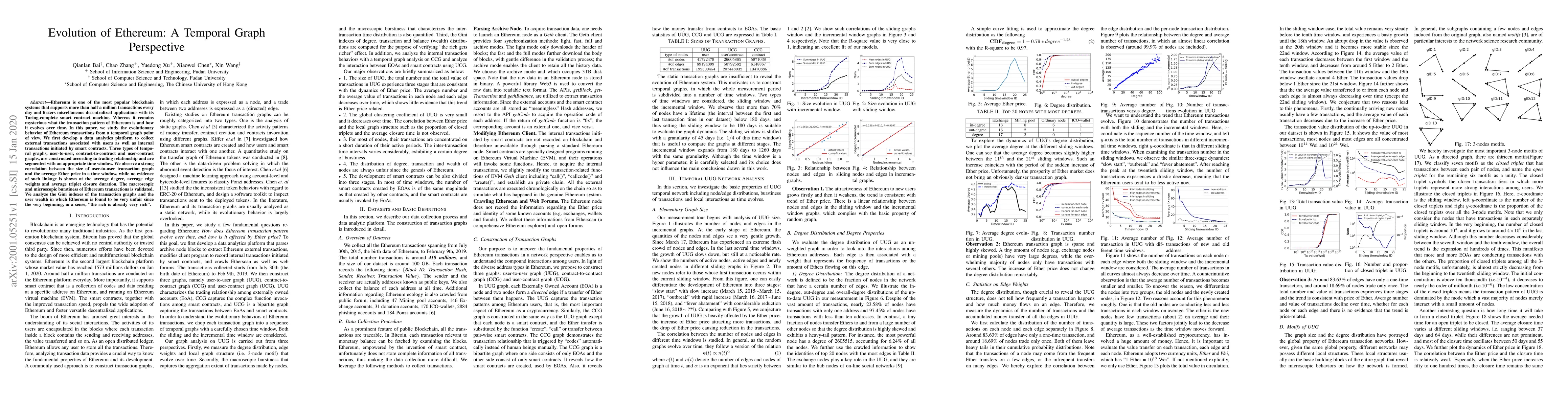

Ethereum is one of the most popular blockchain systems that supports more than half a million transactions every day and fosters miscellaneous decentralized applications with its Turing-complete smart contract machine. Whereas it remains mysterious what the transaction pattern of Ethereum is and how it evolves over time. In this paper, we study the evolutionary behavior of Ethereum transactions from a temporal graph point of view. We first develop a data analytics platform to collect external transactions associated with users as well as internal transactions initiated by smart contracts. Three types of temporal graphs, user-to-user, contract-to-contract and user-contract graphs, are constructed according to trading relationship and are segmented with an appropriate time window. We observe a strong correlation between the size of user-to-user transaction graph and the average Ether price in a time window, while no evidence of such linkage is shown at the average degree, average edge weights and average triplet closure duration. The macroscopic and microscopic burstiness of Ethereum transactions is validated. We analyze the Gini indexes of the transaction graphs and the user wealth in which Ethereum is found to be very unfair since the very beginning, in a sense, "the rich is already very rich".

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTTAGN: Temporal Transaction Aggregation Graph Network for Ethereum Phishing Scams Detection

Chang Liu, Gang Xiong, Gaopeng Gou et al.

Investigating shocking events in the Ethereum stablecoin ecosystem through temporal multilayer graph structure

Matteo Zignani, Cheick Tidiane Ba, Richard G. Clegg et al.

EX-Graph: A Pioneering Dataset Bridging Ethereum and X

Zhen Zhang, Qian Wang, Bingsheng He et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)