Summary

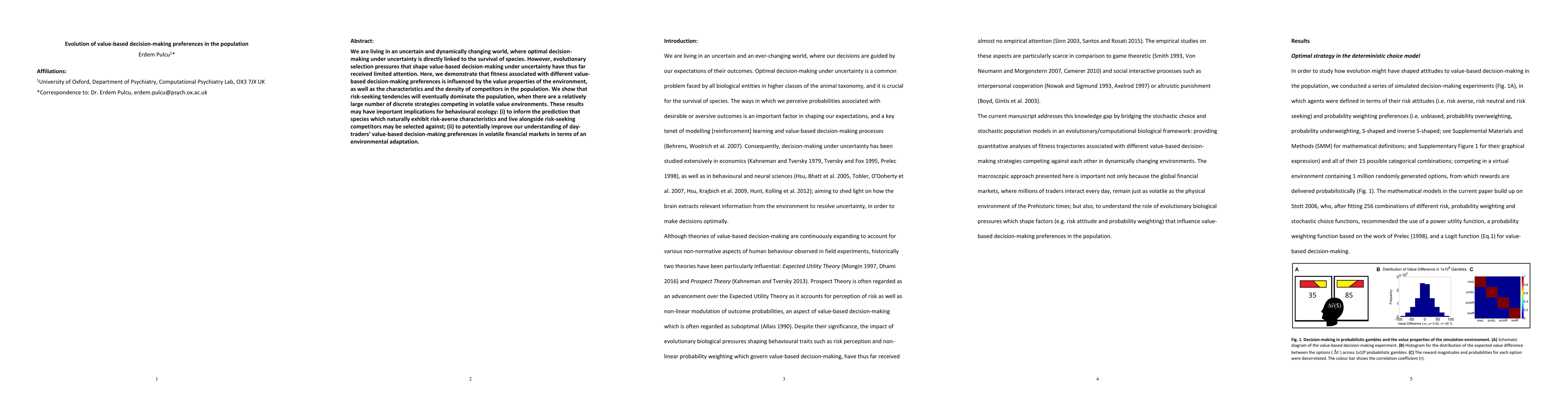

We are living in an uncertain and dynamically changing world, where optimal decision-making under uncertainty is directly linked to the survival of species. However, evolutionary selection pressures that shape value-based decision-making under uncertainty have thus far received limited attention. Here, we demonstrate that fitness associated with different value-based decision-making preferences is influenced by the value properties of the environment, as well as the characteristics and the density of competitors in the population. We show that risk-seeking tendencies will eventually dominate the population, when there are a relatively large number of discrete strategies competing in volatile value environments. These results may have important implications for behavioural ecology: (i) to inform the prediction that species which naturally exhibit risk-averse characteristics and live alongside risk-seeking competitors may be selected against; (ii) to potentially improve our understanding of day-traders value-based decision-making preferences in volatile financial markets in terms of an environmental adaptation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimating the Value of Evidence-Based Decision Making

Guido Imbens, Anish Agarwal, James McQueen et al.

The Value of Information in Human-AI Decision-making

Yifan Wu, Jessica Hullman, Jason Hartline et al.

ValuePilot: A Two-Phase Framework for Value-Driven Decision-Making

Ziang Chen, Xue Feng, Zhenliang Zhang et al.

No citations found for this paper.

Comments (0)