Summary

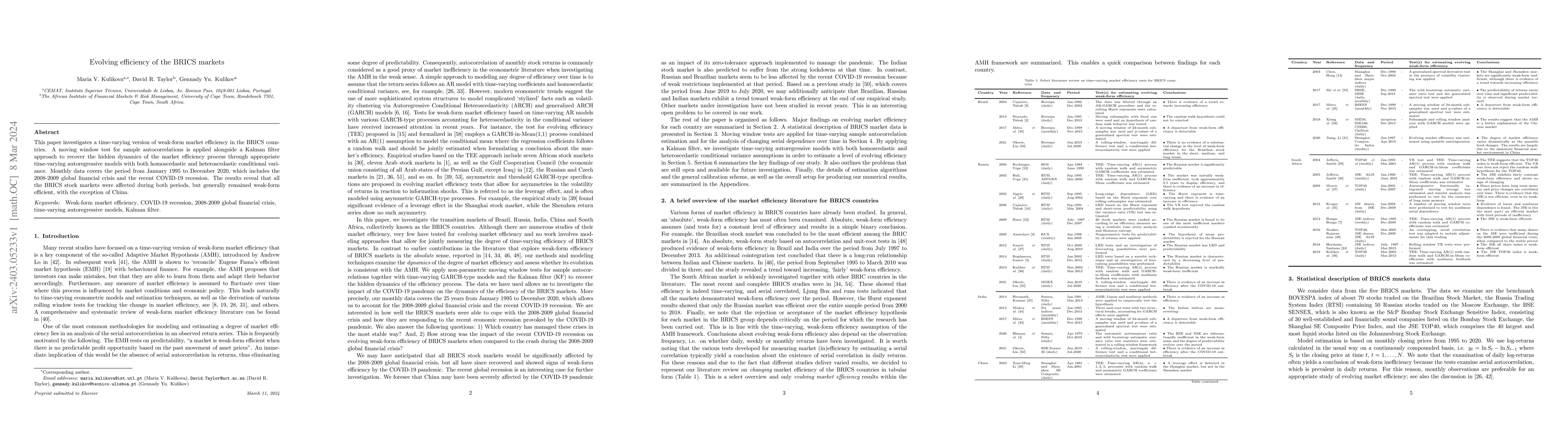

This paper investigates a time-varying version of weak-form market efficiency in the BRICS countries. A moving window test for sample autocorrelations is applied alongside a Kalman filter approach to recover the hidden dynamics of the market efficiency process through appropriate time-varying autoregressive models with both homoscedastic and heteroscedastic conditional variance. Monthly data covers the period from January 1995 to December 2020, which includes the 2008-2009 global financial crisis and the recent COVID-19 recession. The results reveal that all the BRICS stock markets were affected during both periods, but generally remained weak-form efficient, with the exception of China.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterconnected Markets: Exploring the Dynamic Relationship Between BRICS Stock Markets and Cryptocurrency

Wei Wang, Haibo Wang

Risk spillovers between the BRICS and the U.S. staple grain futures markets

Wei-Xing Zhou, Yan-Hong Yang, Ying-Hui Shao

Asymptotic dependence modelling of the BRICS stock markets

Caston Sigauke, Rosinah Mukhodobwane, Wilbert Chagwiza et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)