Summary

We show that the generalized method of moments (GMM) estimation problem in instrumental variable quantile regression (IVQR) models can be equivalently formulated as a mixed integer quadratic programming problem. This enables exact computation of the GMM estimators for the IVQR models. We illustrate the usefulness of our algorithm via Monte Carlo experiments and an application to demand for fish.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

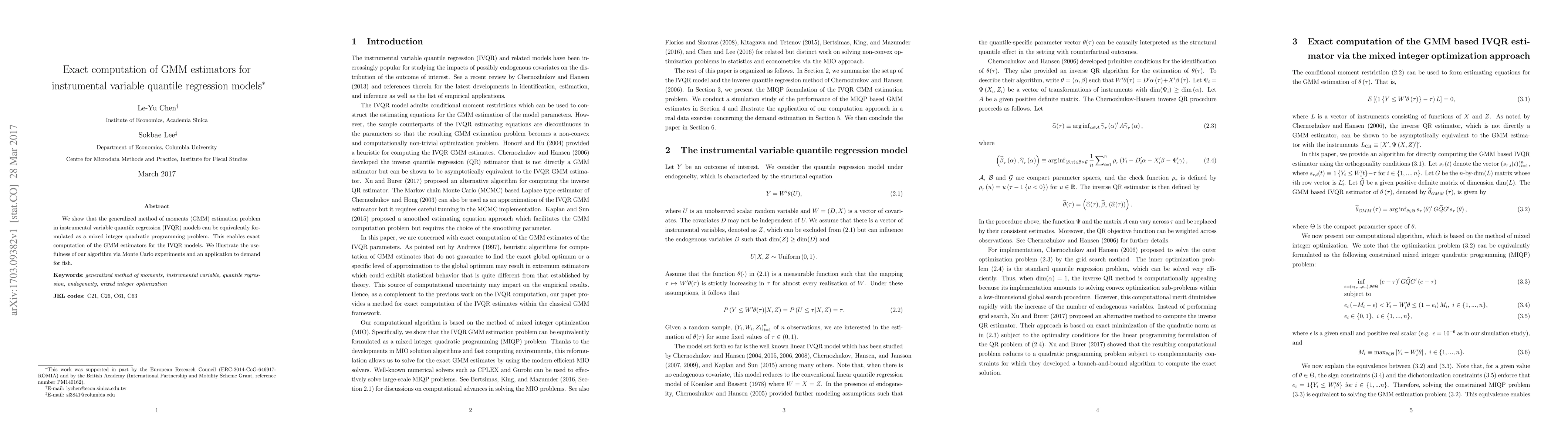

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBias correction for quantile regression estimators

Bulat Gafarov, Kaspar Wuthrich, Grigory Franguridi

| Title | Authors | Year | Actions |

|---|

Comments (0)