Authors

Summary

We consider random-design linear prediction and related questions on the lower tail of random matrices. It is known that, under boundedness constraints, the minimax risk is of order $d/n$ in dimension $d$ with $n$ samples. Here, we study the minimax expected excess risk over the full linear class, depending on the distribution of covariates. First, the least squares estimator is exactly minimax optimal in the well-specified case, for every distribution of covariates. We express the minimax risk in terms of the distribution of statistical leverage scores of individual samples, and deduce a minimax lower bound of $d/(n-d+1)$ for any covariate distribution, nearly matching the risk for Gaussian design. We then obtain sharp nonasymptotic upper bounds for covariates that satisfy a "small ball"-type regularity condition in both well-specified and misspecified cases. Our main technical contribution is the study of the lower tail of the smallest singular value of empirical covariance matrices at small values. We establish a lower bound on this lower tail, valid for any distribution in dimension $d \geq 2$, together with a matching upper bound under a necessary regularity condition. Our proof relies on the PAC-Bayes technique for controlling empirical processes, and extends an analysis of Oliveira devoted to a different part of the lower tail.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

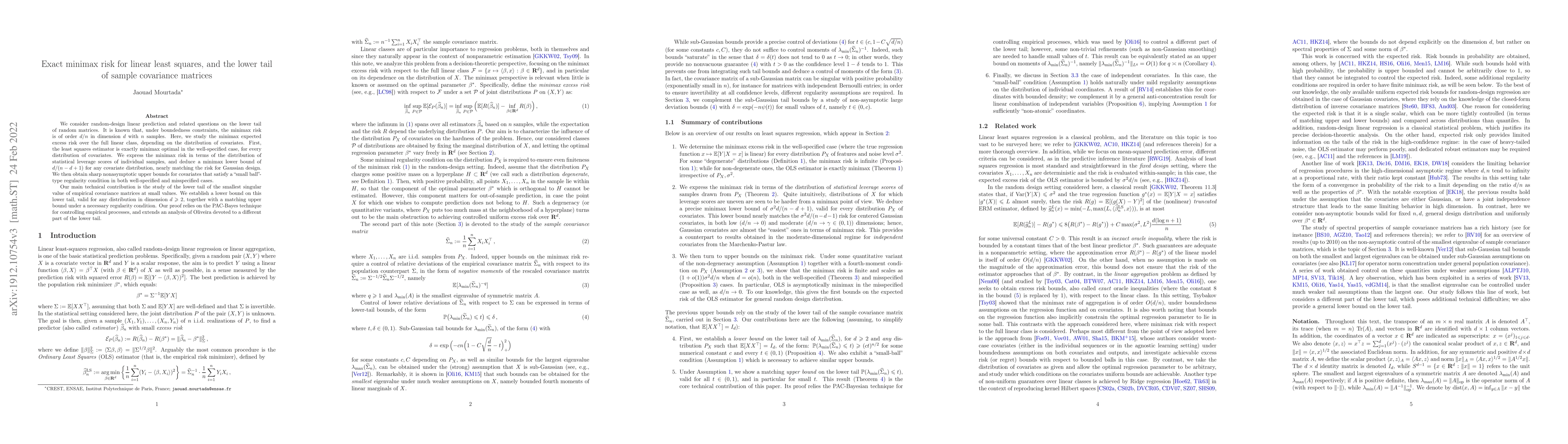

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLinear pooling of sample covariance matrices

Esa Ollila, David E. Tyler, Elias Raninen

| Title | Authors | Year | Actions |

|---|

Comments (0)