Authors

Summary

The problem that is solved in this paper is known as index tracking. The method of Lasso is used to reduce the dimensions of S&P500 index which has many applications in both investment and portfolio management algorithms. The novelty of this paper is that post-selection inference is used to have better modeling and inference for Lasso approach to index tracking. Both confidence intervals and curves indicate that the performance of Lasso type method for dimension reduction of S&P500 is remarkably high. Keywords: index tracking, lasso, post-selection inference, S&P500

AI Key Findings

Generated Sep 03, 2025

Methodology

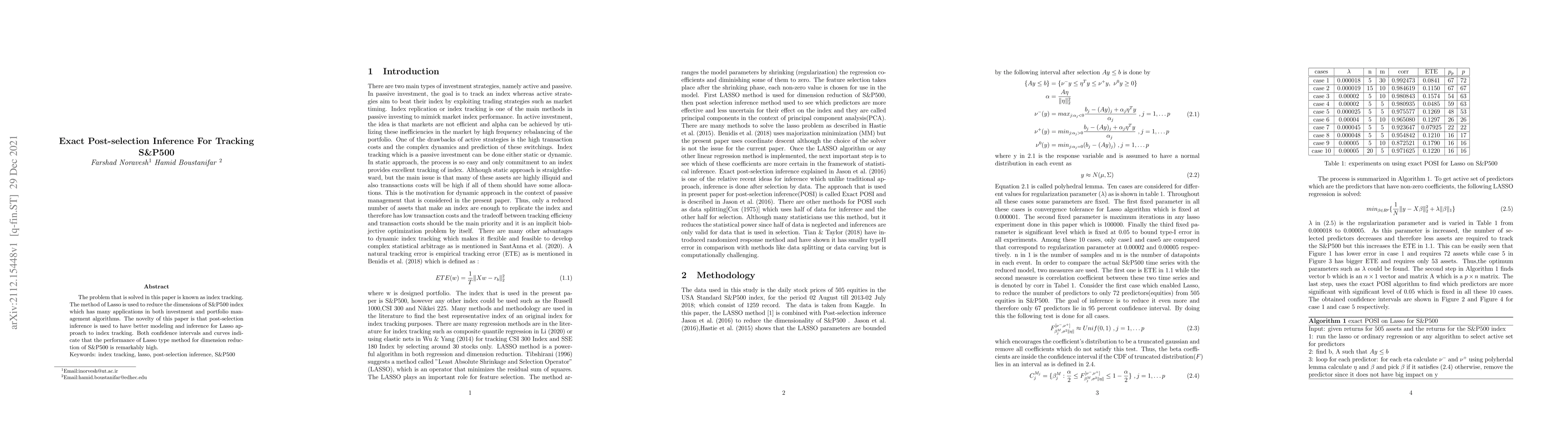

The study uses daily stock prices of 505 equities in the US Standard & Poor's 500 (S&P500) index from August 2, 2013, to July 2, 2018, for dimension reduction. The Lasso method is combined with Post-selection Inference (POSI) to reduce the number of predictors in tracking S&P500. The ExactPOSI algorithm is employed to identify significant predictors with a significance level of 0.05.

Key Results

- The Lasso method effectively reduces the number of predictors from 505 to as few as 72, with 67 predictors lying within the 95% confidence interval in optimal cases.

- The ExactPOSI algorithm successfully identifies significant predictors, providing confidence intervals for the coefficients.

- The approach demonstrates high performance in dimension reduction for S&P500 tracking, as indicated by both confidence intervals and curves.

Significance

This research is important for passive investors seeking to understand the main drivers of S&P500, as it reduces the number of assets needed to track the index efficiently while maintaining accuracy.

Technical Contribution

The paper introduces an Exact Post-selection Inference method tailored for Lasso in tracking S&P500, providing a robust approach for dimension reduction in index tracking.

Novelty

This work stands out by integrating Exact Post-selection Inference with Lasso for dimension reduction in S&P500 tracking, offering improved modeling and inference compared to traditional methods.

Limitations

- The study does not explore the impact of different regularization parameters (λ) beyond the cases presented in Table 1.

- The methodology is limited to daily stock prices and does not consider intraday or alternative high-frequency data.

Future Work

- The algorithm could be extended to higher-moment portfolio optimization by first identifying significant assets for response variables like portfolio variance, skewness, and kurtosis.

- Further research could investigate the application of this method to other financial indices and asset classes.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)