Summary

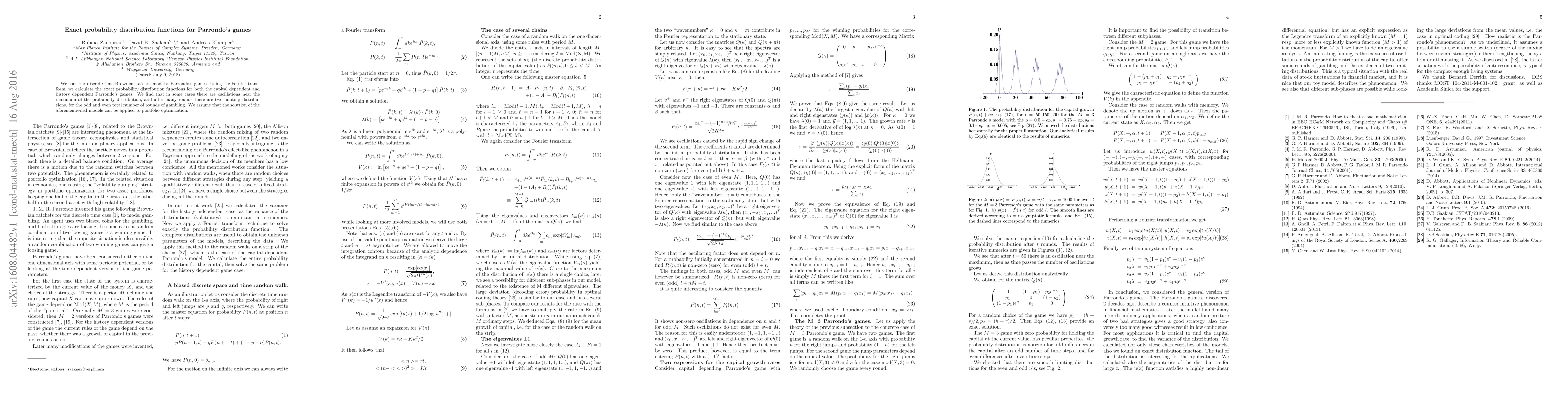

We consider discrete time Brownian ratchet models: Parrondo's games. Using the Fourier transform, we calculate the exact probability distribution functions for both the capital dependent and history dependent Parrondo's games. We find that in some cases there are oscillations near the maximum of the probability distribution, and after many rounds there are two limiting distributions, for the odd and even total number of rounds of gambling. We assume that the solution of the aforementioned models can be applied to portfolio optimization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)