Summary

This study examines the dynamic asset market linkages under the COVID-19 global pandemic based on market efficiency, in the sense of Fama (1970). Particularly, we estimate the joint degree of market efficiency by applying Ito et al.'s (2014; 2017) Generalized Least Squares-based time-varying vector autoregression model. The empirical results show that (1) the joint degree of market efficiency changes widely over time, as shown in Lo's (2004) adaptive market hypothesis, (2) the COVID-19 pandemic may eliminate arbitrage and improve market efficiency through enhanced linkages between the asset markets; and (3) the market efficiency has continued to decline due to the Bitcoin bubble that emerged at the end of 2020.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

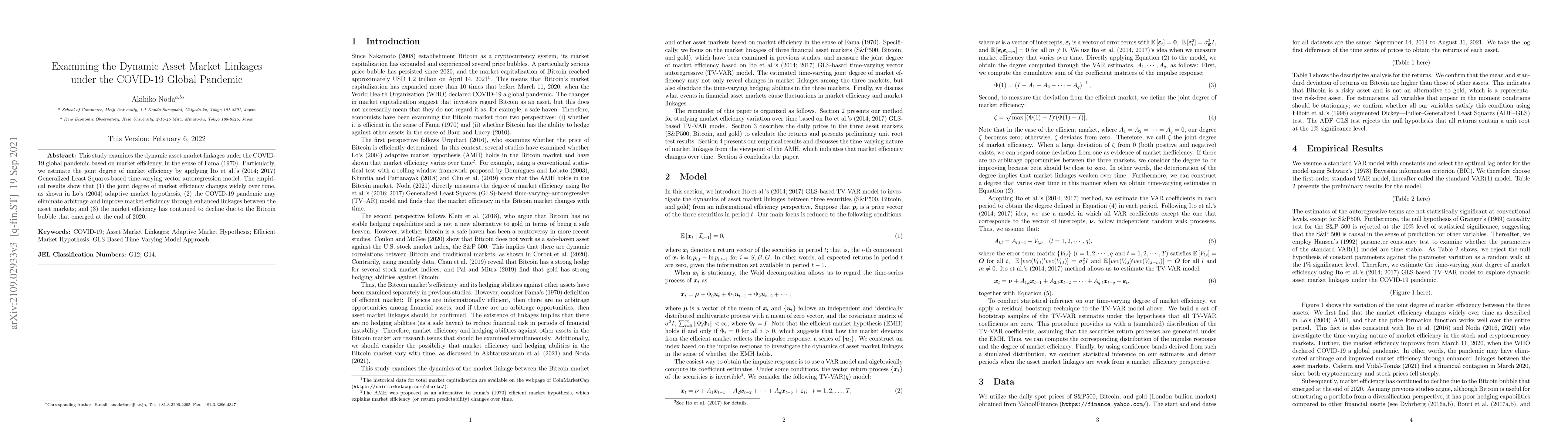

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)