Authors

Summary

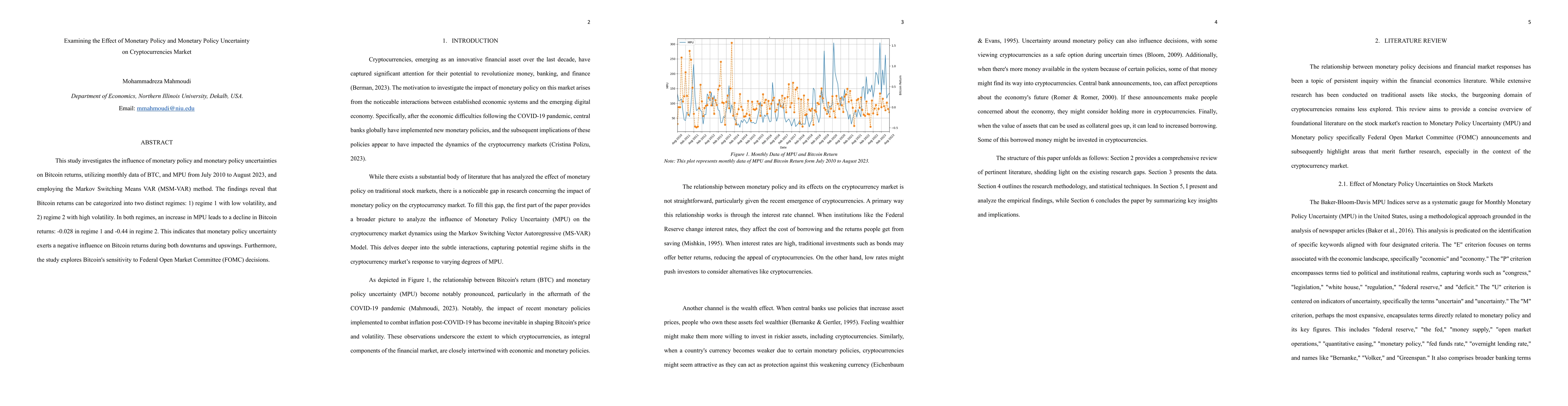

This study investigates the influence of monetary policy and monetary policy uncertainties on Bitcoin returns, utilizing monthly data of BTC, and MPU from July 2010 to August 2023, and employing the Markov Switching Means VAR (MSM-VAR) method. The findings reveal that Bitcoin returns can be categorized into two distinct regimes: 1) regime 1 with low volatility, and 2) regime 2 with high volatility. In both regimes, an increase in MPU leads to a decline in Bitcoin returns: -0.028 in regime 1 and -0.44 in regime 2. This indicates that monetary policy uncertainty exerts a negative influence on Bitcoin returns during both downturns and upswings. Furthermore, the study explores Bitcoin's sensitivity to Federal Open Market Committee (FOMC) decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSpillover Effects of US Monetary Policy on Emerging Markets Amidst Uncertainty

Povilas Lastauskas, Anh Dinh Minh Nguyen

Sentiment Analysis of State Bank of Pakistan's Monetary Policy Documents and its Impact on Stock Market

Aabid Karim, Heman Das Lohano

No citations found for this paper.

Comments (0)