Authors

Summary

A group of people wishes to use money to exchange goods efficiently over several time periods. However, there are disadvantages to using any of the goods as money, and in addition fiat money issued in the form of notes or coins will be valueless in the final time period, and hence in all earlier periods. Also, Walrasian market prices are determined only up to an arbitrary rescaling. Nevertheless we show that it is possible to devise a system which uses money to exchange goods and in which money has a determinate positive value. In this system, tokens are initially supplied to all traders by a central authority and recovered by a purchase tax. All trades must be made using tokens or promissory notes for tokens. This mechanism controls the flow rather than the stock of money: it introduces some trading frictions, some redistribution of wealth, and some distortion of prices, but these effects can all be made small.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

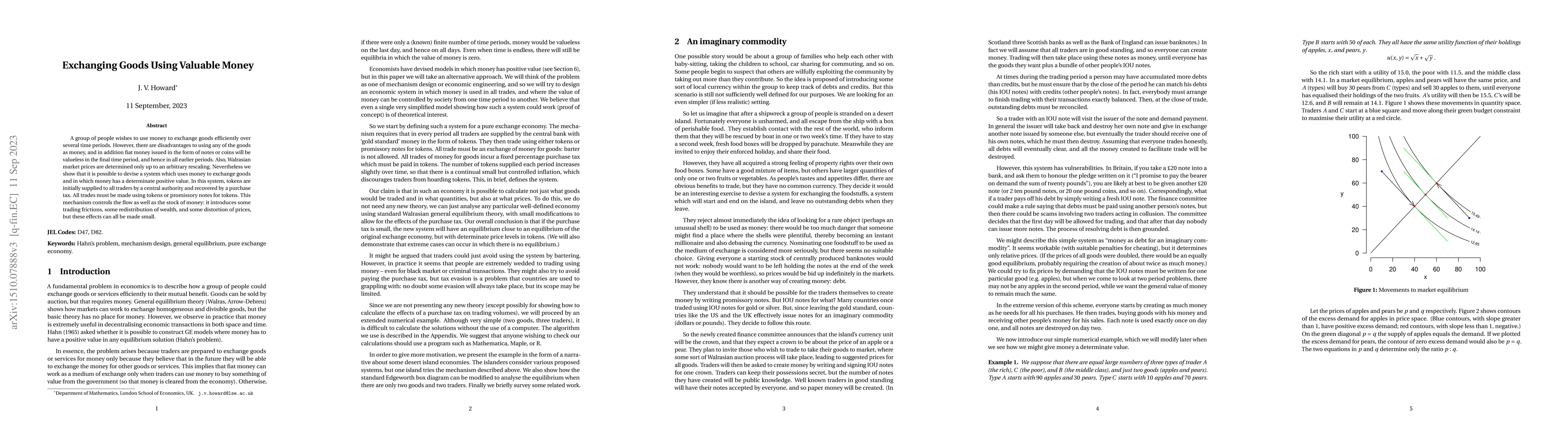

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReforming an Unfair Allocation by Exchanging Goods

Warut Suksompong, Sheung Man Yuen, Ayumi Igarashi et al.

No citations found for this paper.

Comments (0)