Authors

Summary

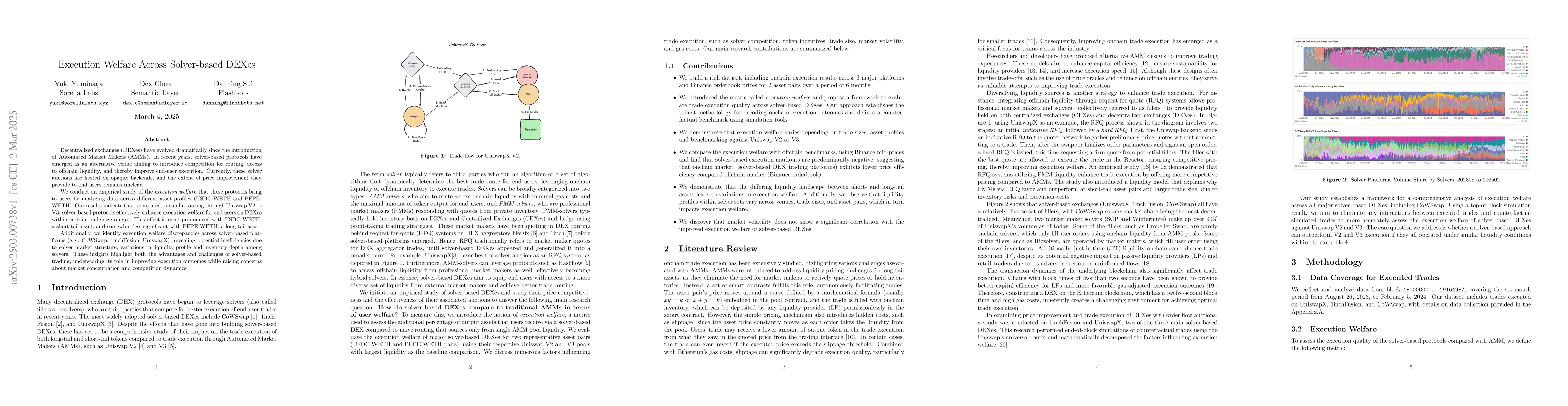

Decentralized exchanges (DEXes) have evolved dramatically since the introduction of Automated Market Makers (AMMs). In recent years, solver-based protocols have emerged as an alternative venue aiming to introduce competition for routing, access to offchain liquidity, and thereby improve end-user execution. Currently, these solver auctions are hosted on opaque backends, and the extent of price improvement they provide to end users remains unclear. We conduct an empirical study of the execution welfare that these protocols bring to users by analyzing data across different asset profiles (USDC-WETH and PEPE-WETH). Our results indicate that, compared to vanilla routing through Uniswap V2 or V3, solver-based protocols effectively enhance execution welfare for end users on DEXes within certain trade size ranges. This effect is most pronounced with USDC-WETH, a short-tail asset, and somewhat less significant with PEPE-WETH, a long-tail asset. Additionally, we identify execution welfare discrepancies across solver-based platforms (e.g., CoWSwap, 1inchFusion, UniswapX), revealing potential inefficiencies due to solver market structure, variations in liquidity profile and inventory depth among solvers. These insights highlight both the advantages and challenges of solver-based trading, underscoring its role in improving execution outcomes while raising concerns about market concentration and competition dynamics.

AI Key Findings

Generated Jun 10, 2025

Methodology

The study employs on-chain data analysis comparing execution quality across UniswapX, 1inchFusion, and CoWSwap to evaluate price improvement brought by solver-based DEX designs against traditional AMMs like UniswapV2 and V3.

Key Results

- Solver-based DEXs consistently offer better execution welfare compared to UniswapV2, particularly for larger trade sizes where solvers optimize routing strategies.

- When benchmarked against UniswapV3, execution welfare improvements are less pronounced and vary based on asset liquidity.

- For long-tail assets like PEPE-WETH, solver-based DEXs demonstrate superior execution, though gains are marginal for more liquid pairs such as USDC-WETH, indicating UniswapV3's concentrated liquidity design remains highly competitive.

- Distinct execution welfare dynamics are driven by differences in liquidity depth and type, with USDC-WETH showing consistent improvement across V2 and V3 due to deep liquidity, while PEPE-WETH benefits more from solver-based venues for larger trades by integrating off-chain liquidity and optimizing order execution.

- Solver execution tends to produce negative markouts relative to the Binance midprice across all cases, suggesting that despite solvers' ability to aggregate on-chain liquidity and utilize RFQ mechanisms, on-chain execution prices often deviate unfavorably from prevailing market conditions, especially for small to medium trade sizes.

Significance

This research provides an empirical evaluation of execution welfare in solver-based decentralized exchanges, offering insights into the performance of these platforms relative to traditional AMMs, which can guide future development and improve end-user trading outcomes.

Technical Contribution

The study presents a structured assessment of execution welfare in solver-based DEXs, leveraging on-chain data to compare performance against traditional AMMs like UniswapV2 and V3, providing insights into the price improvements offered by solver-based designs for both short-tail and long-tail asset pairs.

Novelty

This research distinguishes itself by focusing on execution welfare across solver-based DEXs, analyzing their performance relative to established AMMs, and highlighting the varying effectiveness of solver-based routing and execution strategies depending on asset-specific liquidity distributions.

Limitations

- Limited asset coverage, focusing on USDC-WETH and PEPE-WETH, which may not fully represent short-tail and long-tail assets.

- Execution welfare calculation based on counterfactual simulations using UniswapV2 and V3 liquidity snapshots at the top of each block, which does not capture intra-block liquidity distribution changes.

- Simulation without routing, as the tool does not route across multiple pools, impacting the real-world reflection of optimal routing outcomes achievable by modern aggregators.

- Selection bias on filled orders, as the dataset only includes executed trades that landed on-chain without considering unfilled orders.

- Batch auction delays not captured by the welfare metric, as it evaluates execution quality based on block-time execution rather than the actual time the user submitted the order.

- Gas cost estimation assumes a conservative priority fee-adjusted gas price, which, while realistic, may change the comparison significantly with small adjustments.

Future Work

- Expand analysis to include additional asset pairs across different categories for more robust results.

- Incorporate open-source routing algorithms to compare solver-based platforms with modern DEX aggregators that utilize advanced routing and PMM liquidity via RFQ for a more precise assessment of price improvement attributable to the solver auction mechanism.

- Address selection bias by considering unfilled orders and potential adverse selection behavior from sophisticated solvers.

- Explore methods to estimate and account for batch auction delays to provide a more comprehensive user perspective on execution quality.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Potential of Self-Regulation for Front-Running Prevention on DEXes

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

| Title | Authors | Year | Actions |

|---|

Comments (0)