Summary

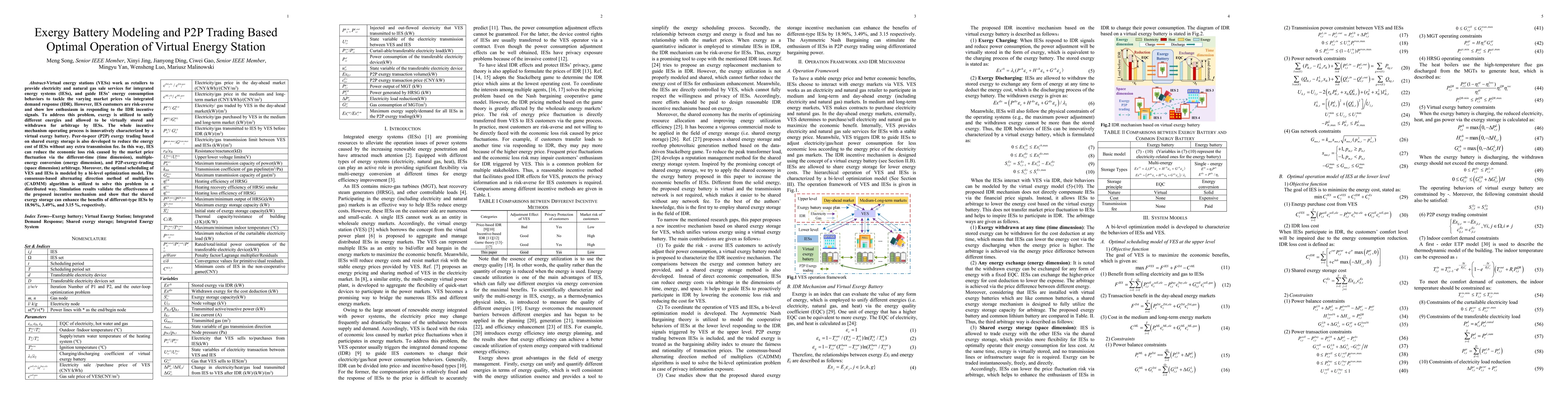

Virtual energy stations (VESs) work as retailers to provide electricity and natural gas sale services for integrated energy systems (IESs), and guide IESs energy consumption behaviors to tackle the varying market prices via integrated demand response (IDR). However, IES customers are risk averse and show low enthusiasm in responding to the IDR incentive signals. To address this problem, exergy is utilized to unify different energies and allowed to be virtually stored and withdrawn for arbitrage by IESs. The whole incentive mechanism operating process is innovatively characterized by a virtual exergy battery. Peer to peer (P2P) exergy trading based on shared exergy storage is also developed to reduce the energy cost of IESs without any extra transmission fee. In this way, IES can reduce the economic loss risk caused by the market price fluctuation via the different time (time dimension), multiple energy conversion (energy dimension), and P2P exergy trading (space dimension) arbitrage. Moreover, the optimal scheduling of VES and IESs is modeled by a bilevel optimization model. The consensus based alternating direction method of multipliers (CADMM) algorithm is utilized to solve this problem in a distributed way. Simulation results validate the effectiveness of the proposed incentive mechanism and show that the shared exergy storage can enhance the benefits of different type IESs by 18.96%, 3.49%, and 3.15 %, respectively.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a bilevel optimization model with the consensus-based alternating direction method of multipliers (CADMM) algorithm to optimize the scheduling of virtual energy stations (VES) and integrated energy systems (IESs).

Key Results

- The proposed incentive mechanism, characterized by a virtual exergy battery, effectively addresses the risk aversion of IES customers and enhances their enthusiasm in responding to integrated demand response (IDR) incentive signals.

- Simulation results demonstrate that shared exergy storage can reduce the energy cost of IESs by 18.96%, 3.49%, and 3.15% for different types of IESs, respectively.

- The model allows for arbitrage across different time dimensions, energy conversion, and peer-to-peer (P2P) exergy trading, mitigating economic loss risk caused by market price fluctuations.

Significance

This research is important as it proposes an innovative solution to encourage customer participation in demand response programs, thereby improving the efficiency and resilience of integrated energy systems.

Technical Contribution

The paper introduces a novel virtual exergy battery model for optimal operation of virtual energy stations, integrating peer-to-peer exergy trading and demand response mechanisms.

Novelty

This work stands out by unifying different energies within a virtual exergy battery framework, enabling arbitrage opportunities across time, energy conversion, and P2P trading dimensions to optimize IES operations.

Limitations

- The paper does not discuss potential challenges in implementing shared exergy storage in existing energy infrastructures.

- Limited information on the scalability of the proposed method for large-scale energy systems.

Future Work

- Investigate the practical implementation and regulatory aspects of the proposed virtual exergy battery model.

- Explore the extension of the model to accommodate more diverse energy sources and larger-scale energy systems.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBlockchain-enabled Energy Trading and Battery-based Sharing in Microgrids

Abdulrezzak Zekiye, Ouns Bouachir, Öznur Özkasap et al.

Credit Blockchain for Faster Transactions in P2P Energy Trading

Yatindra Nath Singh, Amit kumar Vishwakarma

Prospect Theory-inspired Automated P2P Energy Trading with Q-learning-based Dynamic Pricing

Simone Silvestri, Ashutosh Timilsina

No citations found for this paper.

Comments (0)