Summary

With an emphasis on generators with quadratic growth in the control variable we consider measure solutions of BSDE, a solution concept corresponding to the notion of risk neutral measure in mathematical finance. In terms of measure solutions, solving a BSDE reduces to martingale representation with respect to an underlying filtration. Measure solutions related to measures equivalent to the historical one provide classical solutions. We derive the existence of measure solutions in scenarios in which the generating functions are just continuous, of at most linear growth in the control variable (corresponding to generators of at most quadratic growth in the usual sense), and with a random bound in the time parameter whose stochastic integral is a BMO martingale. Our main tools include a stability property of sequences of measure solutions, for which a limiting solution is obtained by means of the weak convergence of measures.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

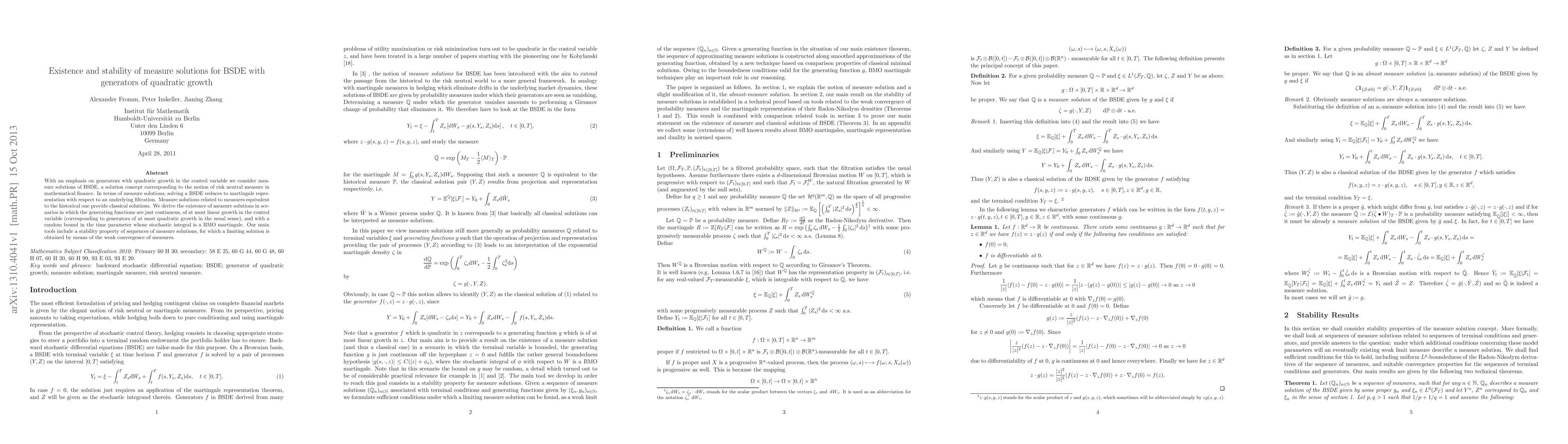

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)