Summary

In equity and foreign exchange markets the risk-neutral dynamics of the underlying asset are commonly represented by stochastic volatility models with jumps. In this paper we consider a dense subclass of such models and develop analytically tractable formulae for the prices of a range of first-generation exotic derivatives. We provide closed form formulae for the Fourier transforms of vanilla and forward starting option prices as well as a formula for the slope of the implied volatility smile for large strikes. A simple explicit approximation formula for the variance swap price is given. The prices of volatility swaps and other volatility derivatives are given as a one-dimensional integral of an explicit function. Analytically tractable formulae for the Laplace transform (in maturity) of the double-no-touch options and the Fourier-Laplace transform (in strike and maturity) of the double knock-out call and put options are obtained. The proof of the latter formulae is based on extended matrix Wiener-Hopf factorisation results. We also provide convergence results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

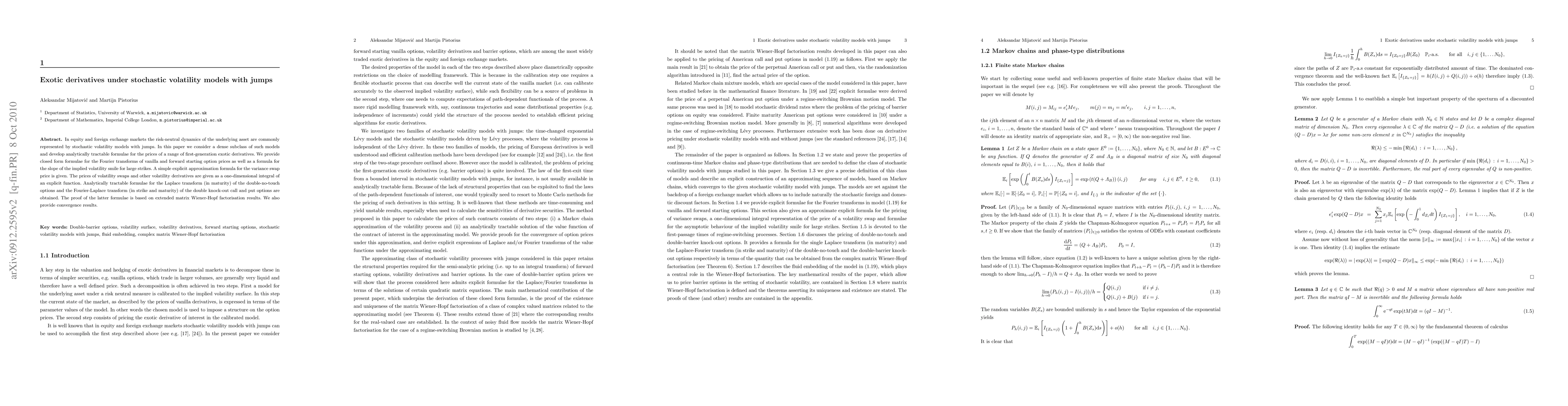

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Efficient Calibration Framework for Volatility Derivatives under Rough Volatility with Jumps

Yuxuan Ouyang, Keyuan Wu, Tenghan Zhong

| Title | Authors | Year | Actions |

|---|

Comments (0)